GST Magazine Update Month of Aug-2021

Click Below link for Buy

| S.No | CONTENTS | Page No. |

| 1. | Important GST and Other Due Date Calendar | 4-5 |

| 2. | Advisory for Taxpayers regarding Blocking of E-Way Bill (EWB) generation facility resume after 15th August, 2021.

FAQs >

|

6-11 |

| 3. | Important notification

|

12-17

|

| 4. | Section 17 (5) Input Tax Credit shall not be available on certain goods/services

Provision of Section 17 (5) Input Tax Credit With Case Law

|

18-22 |

| 5. | Important Case Laws/ Advance Ruling by AUTHORITY ON ADVANCE RULINGS- Month of July -2021

Patna high court quashes GST Assessment order passes without Fair opportunity of hearing IN THE HIGH COURT OF JUDICATURE AT PATNA Civil Writ Jurisdiction Case No.12233 of 2021

|

23-33 |

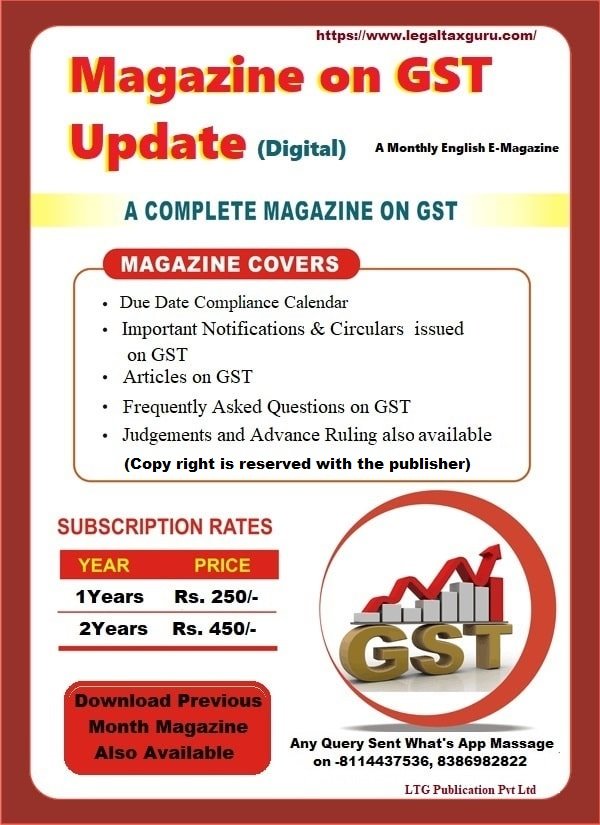

GST E-Magazine Subscriptions (Available Only Digital)

Magazine on GST Update (LTG Publication Pvt Ltd) is a monthly magazine of www.legaltaxguru.com, a premier website for Tax and Legal Update in India. It is drafted by the experts in this region to help common man, professionals, students, Businessman etc. to explain, this highly technical law.

A Complete Magazine on GST

|

Subscription for Online Publication

for Any Query and Complaint Call- 08386982822, and Send What’s App Massage-08386982822, 08114437536 E- Mail ID- legaltaxguru.com@gmail.com, legaltaxguruhosting@gmail.com

Subscription Rates

YEAR |

PRICE |

Click For Subscription(After Payment Send Receipt

|

1 Year |

250/- |

[button color=”blue” link=”https://pages.razorpay.com/legaltaxguru” size=”big” target=”_blank”]Subscribe[/button] |

2 Year |

450/- |

[button color=”blue” link=”https://pages.razorpay.com/pl_HKxk5Ob0gY7z3b/view” size=”big” target=”_blank”]Subscribe[/button] |

Download Free

Download GST MAGAZINE UPDATE MONTH OF APRIL-MAY 2021 (PART-II)-Use Password- Ltgmay@1234 |

|

| (Composition Scheme Special ) GST E-Magazine in English Sample |