ITC NOT ELIGIBLE ON CAPITAL GOODS PROCURED FOR BUILDING LNG JETTIES

GUJARAT APPELLATE AUTHORITY FOR ADVANCE RULING

GOODS AND SERVICES TAX

Case Name: Swan LNG Pvt. Ltd (GST AAAR)

Advance Ruling No. GUJ/GAAAR/APPEAL/2022/06

Date of Judgement/Order: 09/05/2022

Important Point of AAAR Order

- In view of the above discussion, we find that the LNG Jetties being built by the appellant are not in the nature of ‘plant and machinery’ being foundation for equipment, apparatus, machinery for regasification to be installed thereon. Therefore input tax credit on inputs, input services and capital goods for the purpose of building these LNG Jetties are not admissible.

- In view of the foregoing, we reject the appeal filed by M/s. Swan LNG Pvt. Ltd., and confirm the Advance Ruling No. GUJ/GAAR/R/46/2020 dated 30.07.2020 by holding that (1) LNG Jetties being built by the appellant are not covered within the expression ‘plant and machinery’ as foundation to equipment, apparatus, machinery to be installed on it in terms of Section 17 of the CGST Act, 2017 and (2) the appellant cannot avail input tax credit of GST paid on inputs, input services and capital goods procured for the purpose of building the LNG Jetties in terms of Section 16 of the CGST Act, 2017.

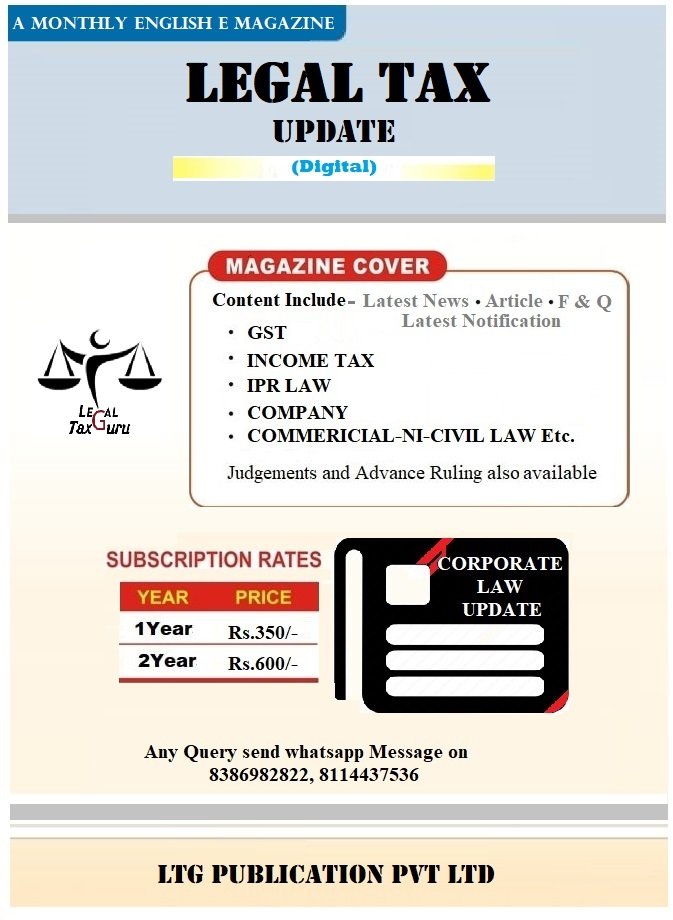

Legal Tax Update E-Magazine Subscriptions- (GST, Income Tax, IPR, Company, Commericial-NI-Civil Law Etc.

Legal Tax Update E-Magazine Subscriptions

(Available Only Digital)

Magazine on Corporate Law Update (LTG Publication Pvt Ltd) is a monthly magazine of www.legaltaxguru.com, a premier website for Tax and Legal Update in India. It is drafted by the experts in this region to help common man, professionals, students, Businessman etc. to explain, this highly technical law.

A Monthly Magazine on Corporate Law Update