What is tax audit?

The dictionary meaning of the term “audit” is check, review, inspection, etc. There are various types of audits prescribed under different laws (Income Tax, GST, Company) like company law requires a company audit, cost accounting law requires a cost audit, GST Law requires a GST Audit etc. The Income tax Act requires the Income taxpayer to get the Tax audit of the accounts of his business/profession from the view point of Income-tax Law.

Section 44AB of Income Tax Act: –

According to Section 44AB of this act gives the provisions relating to the class of Income taxpayers who are required to get their accounts audited from a chartered accountant. The audit under section 44AB of Income tax Act aims to ascertain the compliance of various provisions of the Income-tax Act and the fulfilment of other requirements of the Income-tax Act. The Tax audit conducted by the chartered accountant of the accounts of the Income taxpayer in pursuance of the requirement of section 44AB of the act is called tax audit.

The chartered accountant conducting the tax audit is required to give his findings, observation, review of accounts etc., in the form of Tax Audit report in Form Nos. 3CA, Form Nos.3CB, and 3CD.

Tax Audit Applicability Chart for Individual/HUF/firm engaged in Business

| Turnover of Previous year | Net profit (%) | Condition of cash payment and cash receipts | Tax Audit Applicability |

| Turnover More than 5 Crore | NA | NA | Yes, 44 AB(a) |

| Turnover 2-5 crore | NA | If less than 5% |

No |

| Turnover 2-5 crore | NA | If more than 5% | Yes, 44 AB(a) |

| Turnover1-2 Crore | Net Profit More than 8% or 6% of turnover- who opts for presumptive taxation scheme under section 44AD | NA | No |

| Turnover 1-2 Crore | Net Profit Less than 8% or 6% of turnover | NA | Yes, 44 AB(a) |

| Turnover Up to 1 Crore | Net Profit More than 8% or 6% of turnover | NA | No |

| Turnover Up to 1 Crore | Net Profit Less than 8% or 6% of turnover-who opts for presumptive taxation scheme under section 44AD | NA | Yes, 44AD (e) |

Note:- It is proposed by the Budget-2021 to amend the said provision so as to increase the threshold from “5 Crore” to “10 Crore rupees”

Income Tax Audit Due Date For AY 2021-22

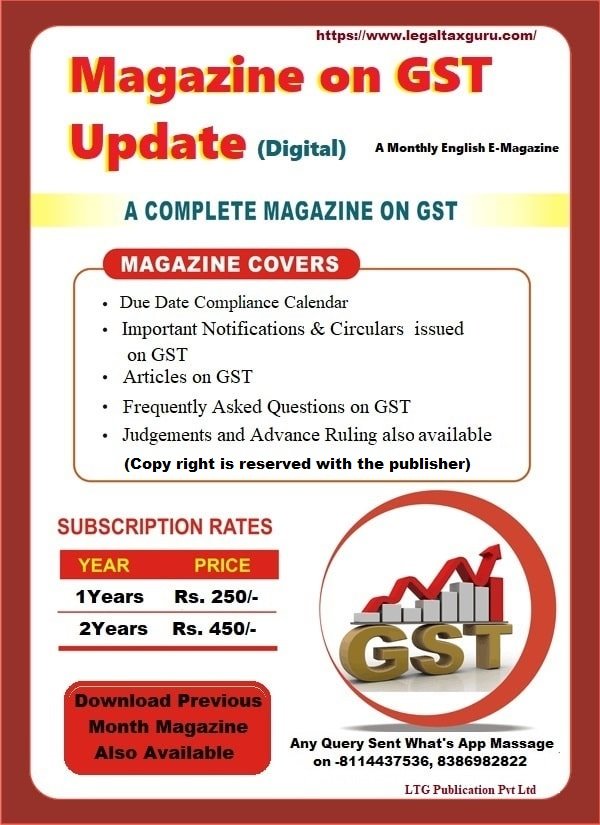

Click on Below Image for more Magazine on GST Update

Extension of Tax Audit Due Date for AY 2021-22– For every year, the due date of furnishing the statutory tax audit report is 30th September of the subsequent year.

For A.Y 2021-22 due to the ongoing COVID-19 pandemic, the Income Tax Audit Due Date for AY 2021-22 has been extended by CBDT vide Circular no. 09/2021: dated 20th May 2021, to 31st October 2021.

| Particulars | Due date | Extended Due date |

| Tax Audit A.Y 2021-22 | 30.09.2021 | 31st October 2021 |

Extension of time limits of -Income Tax Return, Audit Report, TDS Return and other Returns to provide relief to taxpayers in view of the severe pandemic Covid-19 Click Above for more..

Tax Audit Applicability Chart for Individual/HUF/firm engaged in Profession

| Turnover of Previous year for Professionals | Net profit (%) | Tax Audit Applicability |

| Turnover More than 50 lakh | NA | Yes, 44 AB(b) |

| Turnover Less than 50 lakh | Net Profit More than 50 % of turnover | No |

| Turnover Less than 50 lakh | Net Profit Less than 50 % of turnover | Yes, 44 AB(b) |

[news_box style=”1″ link_target=”_blank” show_more=”on” header_background=”#bfbfbf” header_text_color=”#8c1c1c”]