…

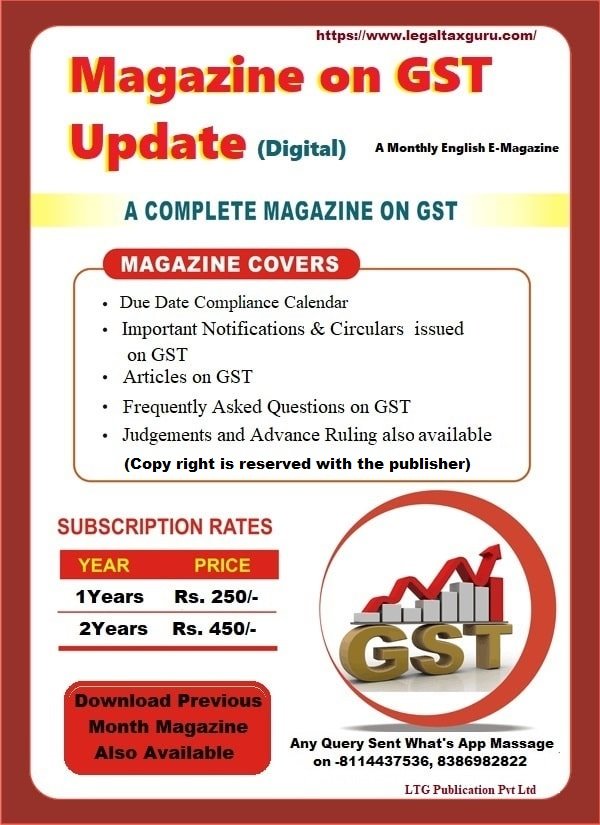

Author: (Team) LTG Publication Private Limited

Availability of Composition Scheme to Works Contractors

Availability of Composition Scheme to Works Contractors Simply put, a works contract is essentially a contract of service which may also involve supply of goods in the execution of the contract. It is basically a composite supply of both services and goods, with the service element being dominant in the contract between parties. In a […]

IS GST APPLICABLE ON HOSTEL RENT ?

GST IS NOT APPLICABLE ON HOSTEL RENT OF LESS THAN RS. 1K PER DAY FOR PER STUDENT MAHARASHTRA AUTHORITY FOR ADVANCE RULINGGOODS AND SERVICES TAX Case Name: Ghodawat Eduserve LLP Appeal Number: Advance Ruling No. GST-ARA- 72/2019-20/B-51Date of Judgement/Order: 27/08/2021 ORDER (Under section 98 of the Central Goods and Services Tax Act, 2017 and the Maharashtra […]

जीएसटी महत्वपूर्ण अंतिम तिथि मार्च – अप्रैल 2022-Important Due Dates March and April-2022

जीएसटी महत्वपूर्ण अंतिम तिथि-Important Due Dates मार्च – अप्रैल 2022 10th अप्रैल 2022 जीएसटीआर-7 में काटे गये और जमा किये गये टीडीएस (TDS) का सारांश मार्च माह 2022 10th अप्रैल 2022 जीएसटीआर–8 ई-कॉमर्स ऑपरेटरों द्वारा जीएसटी से संबंधित एकत्रित किये गए (TCS) का सारांश मार्च माह 2022 11th अप्रैल 2022 जीएसटीआर –1 (मासिक फाइलिंग) मार्च […]

GST LIABILITY ON AMOUNT RECEIVED BY ARBITRATION FOR WORKS EXECUTED IN PRE-GST PERIOD – GST AAR TELANGANA

GST LIABILITY ON AMOUNT RECEIVED BY ARBITRATION FOR WORKS EXECUTED IN PRE-GST PERIOD- GST AAR TELANGANA TELANGANA AUTHORITY FOR ADVANCE RULINGGOODS AND SERVICES TAX Case Name: Continental Engineering CorporationAppeal Number: TSAAR Order No.13/2021Date of Judgement/Order: 08/10/2021 Advance Ruling In view of the observations stated above, the following ruling is issued: Question Raised […]

जीएसटी अपडेट (हिन्दी) मासिक पत्रिका अप्रैल-2022 Date of Pub. :-16.04.2022 E-Magazine on GST Update in Hindi April-22

जीएसटी अपडेट (हिन्दी) मासिक पत्रिका अप्रैल-2022 Online Edition: – 16.04.2022 Price-30/- Subscription for Online Publication 01 Year Rs. 300/– 02 Year Rs. 500/- Call for Booking and Complaint- 08114437536 WhatsApp Number-08114437536, 8386982822 E- Mail ID- legaltaxguru.com@gmail.com Upcoming जीएसटी अपडेट (हिन्दी)- Share on: WhatsApp

Case Name: GEW (India) Pvt. Ltd. – SUPPLY OF WORKS CONTRACT SERVICE IN KARNATAKA SEPARATE REGISTRATION IS NOT REQUIRED

FOR SUPPLY OF WORKS CONTRACT SERVICE IN KARNATAKA SEPARATE REGISTRATION IS NOT REQUIRED KARNATAKA AUTHORITY FOR ADVANCE RULINGGOODS AND SERVICES TAX Case Name: In re GEW (India) Pvt. Ltd. (GST AAR Karnataka)Appeal Number: Advance Ruling No. KAR ADRG 63/2021Date of Judgment /Order: 08/11/2021 RULING i. This authority refrains from giving any ruling in respect of […]

Case Name: Puranik Builders Ltd (GST AAR Maharashtra):-Composite Supply With Main Construction Service Chargeable Under GST

OTHER SERVICES’ NOT PART OF COMPOSITE SUPPLY WITH MAIN CONSTRUCTION SERVICE, CHARGEABLE TO GST @ 18% MAHARASHTRA AUTHORITY FOR ADVANCE RULINGGOODS AND SERVICES TAX Case Name: In re Puranik Builders Ltd. (GST AAR Maharashtra)Appeal Number: Advance Ruling No. GST-ARA- 68/2019-20/B-52Date of Judgement/Order: 27/08/2021 ORDER (Under Section 98 of the Central Goods and Services Tax […]

GST REGISTRATION NOT REQUIRED CHARITABLE TRUST IF ENGAGED IN CHARITABLE ACTIVITIES-GSTAAR MAHARASHTRA

Case Name: Jayshankar Gramin Va Adivasi Vikas Sanstha (GST AARMaharashtra) MAHARASHTRA AUTHORITY FOR ADVANCE RULINGGOODS AND SERVICES TAX Case Name: Jayshankar Gramin Va Adivasi Vikas Sanstha (GST AAR Maharashtra)Appeal Number: Advance Ruling No. GST-ARA-97/2019-20/B-91Date of Judgement/Order: 10/11/2021 ORDER(Under Section 98 of the Central Goods and Services Tax Act, 2017 and theMaharashtra Goods and Services Tax […]

GST NOT LEVIABLE ON FREE OF COST SUPPLY DURING WARRANTY PERIOD – (GST AAR KARNATAKA)

GST NOT LEVIABLE ON FREE OF COST SUPPLY DURING WARRANTY PERIOD – (GST AAR KARNATAKA) KARNATAKA AUTHORITY FOR ADVANCE RULING GOODS AND SERVICES TAX Case Name: South Indian Federation of Fishermen Societies (GST AAR Karnataka) Appeal Number: Advance Ruling No. KAR ADRG 74/2021 Date of Judgement/Order: 06/12/2021 RULING The marine engine and its spare parts […]