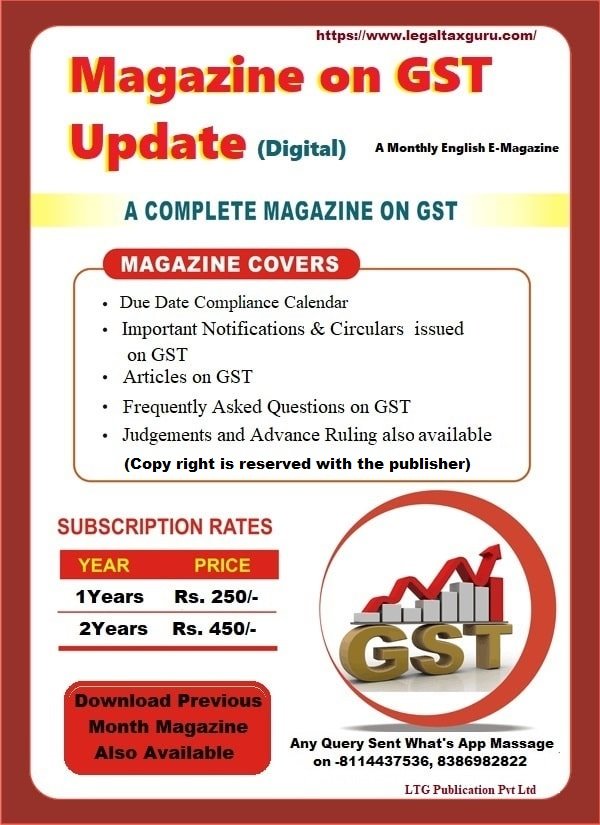

GST E-Magazine Subscriptions-English (Available Only Digital) Magazine on GST Update (LTG Publication Pvt Ltd) is a monthly magazine of www.legaltaxguru.com, a premier website for Tax and Legal Update in India. It is drafted by the experts in this region to help common man, professionals, students, Businessman etc. to explain, this highly technical law. A Complete […]

Feature Post

Feature Post

Revocation of cancellation of GST registration with Procedure for revocation of cancellation-With Fourth Amendment-2021 of CGST Rules

Provision of Revocation of cancellation of GST Registration under Rule 23 of the CGST Rules, 2017 Rule 23 of the CGST Rules:- Sub Rule 1: – A registered person, whose GST Registration is cancelled by the proper officer of GST on his own motion, may submit an application for revocation of cancellation of GST Registration, […]

Difference Between Advocate and Notary Public-with Definition, Position, Registration

Difference between Advocate and Notary public Share on: WhatsApp

GST Update Magazine Subscriptions-Also Available Free

GST E-Magazine Subscriptions (Available Only Digital) Magazine on GST Update (LTG Publication Pvt Ltd) is a monthly magazine of www.legaltaxguru.com, a premier website for Tax and Legal Update in India. It is drafted by the experts in this region to help common man, professionals, students, Businessman etc. to explain, this highly technical law. A Complete […]

What is the impact of Section 16(2) (aa) of CGST Act -20170-With amended Rule 59 of CGST Rule

What is New Provision as per section 16(2) (aa)? Recently inserted new Section 16(2) (aa) of CGST Act Finance Bill, 2021. In this Article we are trying to discuss & analysis of Section 16(2) (aa) with Section 37 of CGST Act-2017. Provision as per Law 16(2) (aa) The details of the Tax Invoice/Bill or debit […]

Sample Franchise Agreement Format – with Word Format Download

Sample franchise agreement Format AGREEMENT This agreement is made on ________day of ___________, between M/s ABC Pvt Ltd through its Director Mr A Soni S/o Shri B Soni having its registered office 1, ……………………………………………………………………… Delhi- & Corporate office at 2, ………………………………………………, (U.P) (Hereinafter called the party of the First part or the Company or […]

NOC Letter Format for GST Registration in Word-Available for Downloads

NOC for Address Proof for GST Registration NOC FOR REGISTERED OFFICE ADDRESS I, A PAREEK S/O SH. B PAREEK R/o 1, ……………………………………………………………. JAIPUR-302011 INDIA DO DECLARE AND AFFIRM THAT: That I own the premises situated at 2, Ram Nagar, ………………………………………………………………….-302011, Rajasthan. The promoters of the proposed company ABC Private Limited have approached me for providing […]

Case Law- Provisions of section 271AAB of Income Tax Act || Shiv Bhagwan Gupta S/o Lt. Badri Prasad G vs Asst Commissioner of Income Tax

Provisions of section 271AAB of Income IN THE INCOME TAX APPELLATE TRIBUNALPATNA BENCH “SMC” AT KOLKATA Shiv Bhagwan Gupta S/o Lt. Badri Prasad G vs Asst. Commissioner of Income-tax, Central Circle-1, Patna.- ITA No.194/Pat/2019. Dated:- 20, March 2021 Short Summary Provisions of section 271AAB of Income Tax Act 1961, it is evident that the Section […]

43rd GST Council Meeting Updates and Highlights ||FM Announced Amnesty Scheme

43rd GST Council Meeting Updates The GST Council is meeting for its first meeting in after seven months meeting:- 43rd GST Council Meeting Highlights Trade Body and Indian Chamber of Commerce and Industry Appeals to FM to Extend Time for Filing GSTR 3B. GST Amnesty Scheme for all Small Taxpayers (MSME) The GST Council is […]

INTELLECTUAL PROPERTY RIGHTS : AN ANALYTICAL STUDY PPT Presentation

INTELLECTUAL PROPERTY RIGHTS : An Analytical Study with Competition Law PPT on INTELLECTUAL PROPERTY RIGHTS : AN ANALYTICAL STUDY Download PPT on Appeals and Review Mechanism Under GST A STUDY OF LAW RELATING TO Appeals and Review Mechanism under GST CHAPTER-I Introduction Intellectual Property Intellectual Property System in India CHAPTER-II Patent Law Concept of […]