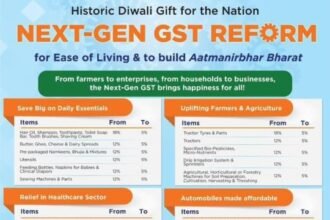

MAJOR GST REFORMS 2025: BIG RELIEF FOR CONSUMERS & BUSINESS

MAJOR GST REFORMS 2025: BIG RELIEF FOR CONSUMERS & BUSINESS The Government…

Second-Hand Goods: Margin Scheme Excludes Repair Costs; No ITC on Improvements

Case Name: Jitendra Equipment (GST AAR Gujarat) Case No. GUJ/GAAR/R/2025/05 Dated- 21.03.2025

Service Tax on Clause 66E(e): Finance Act India Guide

Circular No. 214/1/2023-Service Tax date: 28th February, 2023 An issue has arisen…

Union Budget 2025 Key features on Income Tax \Finance Bill 2025

Union Budget 2025 Key features\Finance Bill 2025 Direct Tax proposals Introduction of …

GST Clarification on various issues pertaining to GST treatment of vouchers-Circular No. 243/37/2024-GST

Clarification on various issues pertaining to GST treatment of vouchers- . Circular…

FINANCE BILL 2024: INSERTION OF NEW SECTION 128A IN CGST ACT 2017

Conditional Waiver to Interest/ Penalty relating to demand raised u/s 73 of…

FINANCE BILL 2024: INSERTION OF SECTION 74 A IN CGST ACT, 2017

The Finance Bill 2024, introduced in Parliament on 23rd July 2024, proposes…

Finance Bill 2024: Amendment to Section 16 of CGST Act, 2017

Amendment to Section 16 of CGST Act, 2017 The Finance Bill 2024,…

E-Magazine on Tax Update Part-5 (June-2024) || Online Publication-13.07.2024

Magazine on Tax Update Part-5 (June-2024) || Online Publication-13.07.2024 Subscription Option Available…

53वीं जीएसटी काउंसिल की बैठक के नए निर्णय से मिली व्यापारियों/ कारोबारियों को राहत |

जीएसटी काउंसिल की बैठक के नए निर्णय से मिली व्यापारियों/ कारोबारियों को…