E-Magazine on GST Update-in English Magazine on GST Update (LTG Publication Pvt Ltd) is a monthly magazine of www.legaltaxguru.com, a premier website for Tax and Legal Update in India. E-Magazine on GST Update Published After 01.09.2021 between 05th to 10th day of every month, if non receipt of any part then informed on WhatsApp number:- […]

GST Article

GST ARTICLE

This website provides free article on Important topics of GST.

We also provide various useful Detail related to above laws in excel and word format. And We will be Providing free consultancy for query related to to above topic

All Copyright reserved by legaltaxguru.com no part of the website can be re-publish or re-produced in any manner without the written permission of the publisher.

Author, editors publishers, contributor are not responsible for the result of any action taken on the basis of this work, any error or omission to any person, whether a Viewing on site or not(Detail Provide in GST Category).

It is suggested that to avoid any doubt should cross check all the facts, law and contents of the publication with original government publication of Gazette Notification, Act, Rule etc.

GST Compliance Extended and Due date month of July-2021

GST Compliance Extended Due Date/Due date month of July-2021 Particulars Applicable Period Extended Date/ Due Date Form GSTR 3B for turnover below 5 crores April 2021 04.07.2021 Form GSTR 3B for turnover above 5 crores Also Option Available Magazine on GST Update- A Monthly E-Magazine (English) May 2021 05.07.2021 Form GSTR- 8 E-Commerce Operator […]

Magazine on GST Update- A Monthly E-Magazine (English)

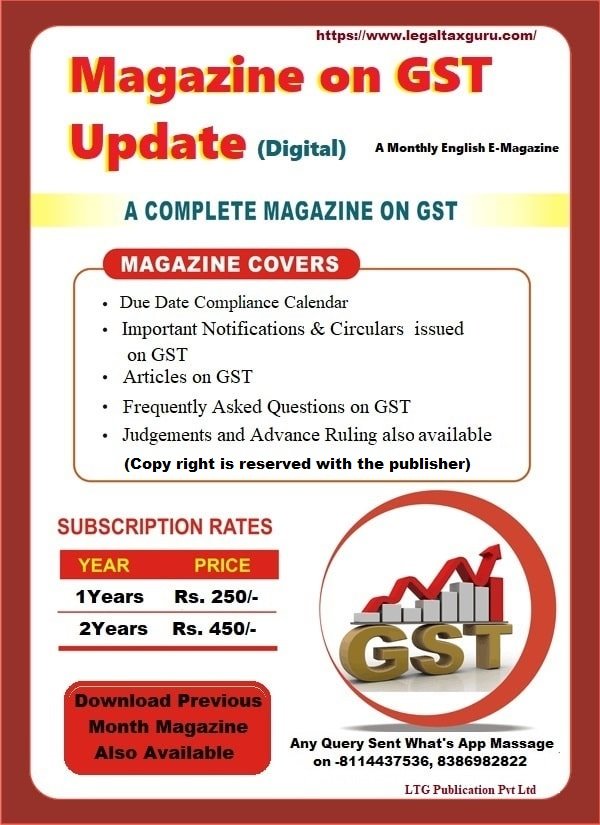

Magazine on GST Update- A Monthly E-Magazine (English) Subscription Magazine on GST Update Magazine on GST Update (LTG Publication Pvt Ltd) is a monthly magazine of www.legaltaxguru.com, a premier website for Tax and Legal Update in India. It is drafted by the experts in this region to help common man, professionals, students, Businessman etc. to explain, […]

Revocation of cancellation of GST registration with Procedure for revocation of cancellation-With Fourth Amendment-2021 of CGST Rules

Provision of Revocation of cancellation of GST Registration under Rule 23 of the CGST Rules, 2017 Rule 23 of the CGST Rules:- Sub Rule 1: – A registered person, whose GST Registration is cancelled by the proper officer of GST on his own motion, may submit an application for revocation of cancellation of GST Registration, […]

GST Update Magazine Subscriptions-Also Available Free

GST E-Magazine Subscriptions (Available Only Digital) Magazine on GST Update (LTG Publication Pvt Ltd) is a monthly magazine of www.legaltaxguru.com, a premier website for Tax and Legal Update in India. It is drafted by the experts in this region to help common man, professionals, students, Businessman etc. to explain, this highly technical law. A Complete […]

Clarification regarding GST on supply of various Education services by Examination Board

Clarification regarding GST on supply of various services by Central and State Board and such as National Board of Examination- Circular No. 151/07/2021-GST Dated 17.06.2021 Clarification regarding GST on supply of various Education services :-Certain representations have been received seeking clarification in regarding of taxability of various services supplied by State Boards and Centre Boards […]

Recommendations of 44th Meeting of GST Council -Coronavirus Disease relief

Change in GST Rates on goods being used in Covid-19 (Coronavirus disease) relief and management The 44th meeting of GST Council under the Chairmanship of UFCA Minister Smt Nirmala Sitharaman through video conferencing here today. The Council in its meeting has decided to reduce the GST rates on the specified items being used in Coronavirus Disease […]

GST Compliance Extended Due date month of June-2021

GST Compliance Extended Due date month of June-2021 Extended Due Date Form/ Particular Month/Period 04th June, 2021 Form GSTR – 3B return for the month of April, 2021: a. Aggregate turnover More than Rs. 5 crores during previous year b. Aggregate turnover of less then Rs. 5 Crores for registered person opted for monthly return April, […]

COVID-19 Relief in 43rd GST Council meeting Dated 28.05.2021- With Press Release

Relief in of 43rd GST Council meeting The 43rd GST Council meeting under the Chairmanship of Finance Minister Smt. Nirmala Sitha raman through video conferencing here 28.05.2021. The meeting was also attended by Union Minister of State for Finance & Corporate Affairs Shri Anurag Thakur besides Finance Ministers of States & UTs and senior officers […]

43rd GST Council Meeting Updates and Highlights ||FM Announced Amnesty Scheme

43rd GST Council Meeting Updates The GST Council is meeting for its first meeting in after seven months meeting:- 43rd GST Council Meeting Highlights Trade Body and Indian Chamber of Commerce and Industry Appeals to FM to Extend Time for Filing GSTR 3B. GST Amnesty Scheme for all Small Taxpayers (MSME) The GST Council is […]