महत्वपूर्ण अंतिम तिथि नवंबर-दिसंबर-2023 20th नवंबर 2023 जीएसटीआर–5A ऑनलाइन सूचना और डेटाबेस एक्सेस या रिट्रीवल सर्विसेज (OIDAR) देने वाले के द्वारा आउटवार्ड टैक्सेबल सप्लाई (मासिक फाइलिंग) अक्टूबर –2023 20th नवंबर 2023 जीएसटीआर-3B (मासिक फाइलिंग) अक्टूबर –2023 (पिछले वित्तीय वर्ष में 5 करोड़ रुपये से अधिक के एग्रीगेट टर्नओवर के लिए) or मासिक फाइलिंग 10th […]

Tax News

Tax News

जीएसटी अपडेट (हिन्दी) मासिक पत्रिका अगस्त- Date of Pub. :- 10.09.2023

E-GST Update-Hindi Month of August– Date of Pub. :- 10.09.2023 Price-35/- Also Subscription Option Available Subscription Rates (Hindi) YEAR PRICE Click For Subscription (After Payment Send Receipton What’s App Number- 8386982822 ) 1 Year 299/- Subscribe 2 Year 499/- Subscribe Download Free (Hindi)-GST Magazine in Hindi Download मासिक पत्रिका फरवरी-2023 Download Download मासिक पत्रिका […]

महत्वपूर्ण अंतिम तिथि- जुलाई-अगस्त Important Due Dates

महत्वपूर्ण अंतिम तिथि Important Due Dates 20th जुलाई 2023 जीएसटीआर-3B (मासिक फाइलिंग) जून –2023 (पिछले वित्तीय वर्ष में 5 करोड़ रुपये से अधिक के एग्रीगेट टर्नओवर के लिए) or मासिक फाइलिंग जीएसटीआर-3B QRMP योजना का विकल्प चुनने व पिछले वित्तीय वर्ष में 5 करोड़ रुपये से तक के एग्रीगेट टर्नओवर के लिए) (तिमाही फाइलिंग) अप्रैल […]

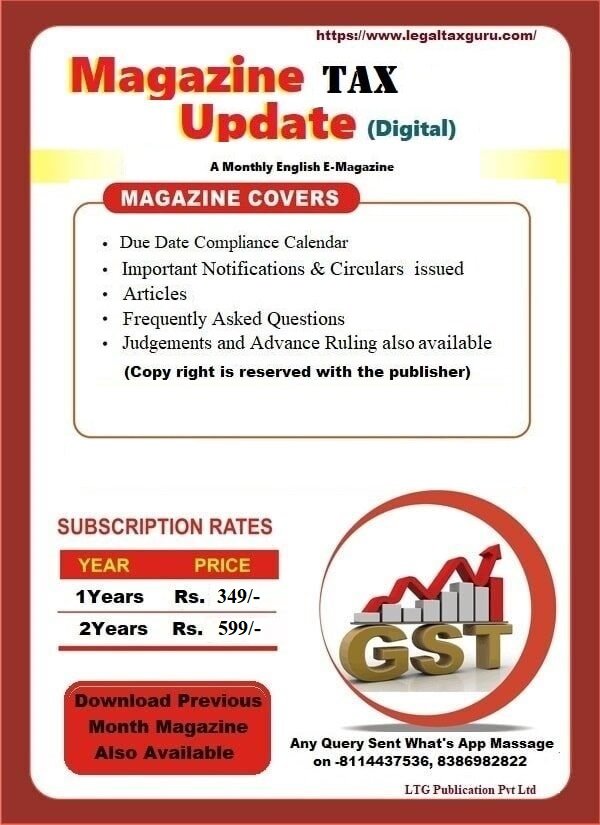

E-Magazine on Tax Update Hindi or English

Magazine on Tax Update After Payment Share Receipt on 8386982822 Also Subscription Option Available For Online Payment Subscription Charges Click below link E-Subscription Rates YEAR PRICE Click For Subscription of E-Tax Update (After Payment Send Receipton What’s App Number- 8386982822 )-Kindly do not Subscribe those who have already made Subscription of Tax English E […]

जीएसटी अपडेट (हिन्दी) || Date of Pub. :- 25.04.2023 मासिक पत्रिका अप्रैल-2023-( एडवांस रुलिंग्स (Advance Ruling))

मासिक पत्रिका अप्रैल-2023- एडवांस रुलिंग्स (Advance Ruling) Upcoming Date of Online Edition: 20.05.2023 Price-50/- Also Subscription Option Available Subscription Rates (Hindi) YEAR PRICE Click For Subscription (After Payment Send Receipton What’s App Number- 8386982822 ) 1 Year 299/- Subscribe 2 Year 499/- Subscribe Download Free (Hindi) Download मासिक पत्रिका सितंबर-2021 Download E-Subscription Rates […]

Due Date Calendar March-April 2023

Due Date Calendar March-April 2023 Due Date Calendar March-april 2023 10th April 2023 GSTR 8 (Monthly) for March-2023 (filed by the e-commerce operators who are required to deduct Tax Collected at Source (TCS) under GST) 11th April 2023 GSTR 1 (Monthly) for March-2023 13th April 2023 GSTR 1 IFF or QRMP for (Quarterly) Jan to […]

जीएसटी की महत्वपूर्ण अंतिम तिथि फाइलिंग मार्च 2023 GST Important Due Dates month of March-2023

महत्वपूर्ण अंतिम तिथि Important Due Dates फरवरी 2023 10th मार्च 2023 जीएसटीआर-7 में काटे गये और जमा किये गये टीडीएस (TDS) का सारांश फरवरी -2023 10th मार्च 2023 जीएसटीआर–8 ई-कॉमर्स ऑपरेटरों द्वारा जीएसटी से संबंधित एकत्रित किये गए (TCS) का सारांश फरवरी –2023 11th मार्च 2023 जीएसटीआर –1 (मासिक फाइलिंग) फरवरी –2023 (सालाना 5 करोड़ रुपये […]

Amendment of Section 44AD and 44ADA Budget 2023

Amendment of section 44AD Special provision for computing profits and gains of business on presumptive basis. In section 44AD of the Income-tax Act, in the Explanation, in clause (b), after sub-clause (ii), the following provisos shall be inserted. effect from the 1st day of April, 2024, namely:– ‘Provided that where the amount or aggregate of […]

Proposed Changes in Tax Rates-Budget 2023

Proposed Changes in Tax Rates-Budget 2023 In the alternate tax regime under Section 115BAC, a revision to the basic exemption limit and the number of slabs has been proposed. The revised basic exemption limit shall be INR 3,00,000 and for every additional INR 3,00,000 of income, the next slab rate will be applicable. The highest […]

जीएसटी अपडेट (हिन्दी) | मासिक पत्रिका जनवरी-2023-| Date of Pub. :- 25.01.2023

जीएसटी अपडेट (हिन्दी) | मासिक पत्रिका जनवरी-2023- Online Edition: – 25.01.2023 Also Subscription Option Available Subscription Rates (Hindi) YEAR PRICE Click For E-Subscription (After Payment Send Receipton What’s App Number- 8386982822 […]