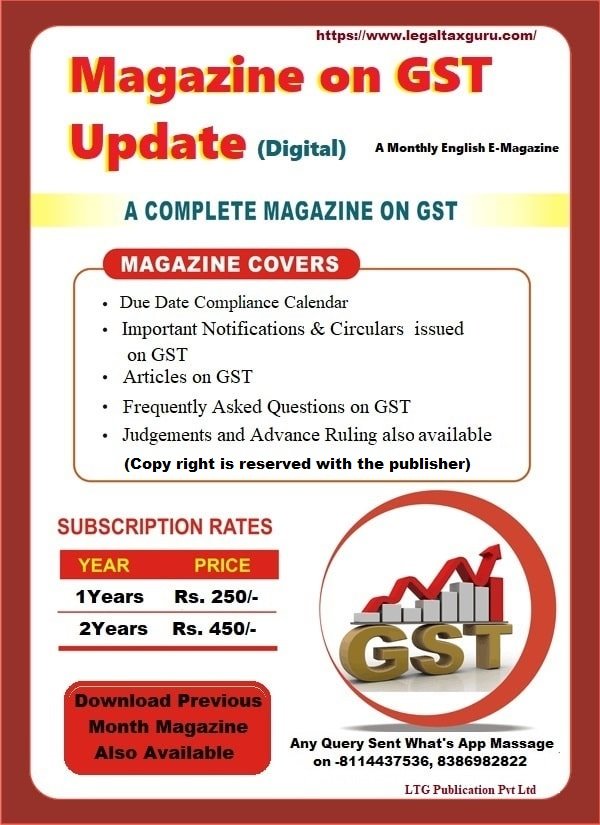

GST E-Magazine Subscriptions-English (Available Only Digital) Magazine on GST Update (LTG Publication Pvt Ltd) is a monthly magazine of www.legaltaxguru.com, a premier website for Tax and Legal Update in India. It is drafted by the experts in this region to help common man, professionals, students, Businessman etc. to explain, this highly technical law. A Complete […]

Tax News

Tax News

E-Magazine on GST Update-in English

E-Magazine on GST Update-in English Magazine on GST Update (LTG Publication Pvt Ltd) is a monthly magazine of www.legaltaxguru.com, a premier website for Tax and Legal Update in India. E-Magazine on GST Update Published After 01.09.2021 between 05th to 10th day of every month, if non receipt of any part then informed on WhatsApp number:- […]

GST Compliance Extended and Due date month of July-2021

GST Compliance Extended Due Date/Due date month of July-2021 Particulars Applicable Period Extended Date/ Due Date Form GSTR 3B for turnover below 5 crores April 2021 04.07.2021 Form GSTR 3B for turnover above 5 crores Also Option Available Magazine on GST Update- A Monthly E-Magazine (English) May 2021 05.07.2021 Form GSTR- 8 E-Commerce Operator […]

Magazine on GST Update- A Monthly E-Magazine (English)

Magazine on GST Update- A Monthly E-Magazine (English) Subscription Magazine on GST Update Magazine on GST Update (LTG Publication Pvt Ltd) is a monthly magazine of www.legaltaxguru.com, a premier website for Tax and Legal Update in India. It is drafted by the experts in this region to help common man, professionals, students, Businessman etc. to explain, […]

GST Update Magazine Subscriptions-Also Available Free

GST E-Magazine Subscriptions (Available Only Digital) Magazine on GST Update (LTG Publication Pvt Ltd) is a monthly magazine of www.legaltaxguru.com, a premier website for Tax and Legal Update in India. It is drafted by the experts in this region to help common man, professionals, students, Businessman etc. to explain, this highly technical law. A Complete […]

What is the impact of Section 16(2) (aa) of CGST Act -20170-With amended Rule 59 of CGST Rule

What is New Provision as per section 16(2) (aa)? Recently inserted new Section 16(2) (aa) of CGST Act Finance Bill, 2021. In this Article we are trying to discuss & analysis of Section 16(2) (aa) with Section 37 of CGST Act-2017. Provision as per Law 16(2) (aa) The details of the Tax Invoice/Bill or debit […]

GST Compliance Extended Due date month of June-2021

GST Compliance Extended Due date month of June-2021 Extended Due Date Form/ Particular Month/Period 04th June, 2021 Form GSTR – 3B return for the month of April, 2021: a. Aggregate turnover More than Rs. 5 crores during previous year b. Aggregate turnover of less then Rs. 5 Crores for registered person opted for monthly return April, […]

Case Law- Provisions of section 271AAB of Income Tax Act || Shiv Bhagwan Gupta S/o Lt. Badri Prasad G vs Asst Commissioner of Income Tax

Provisions of section 271AAB of Income IN THE INCOME TAX APPELLATE TRIBUNALPATNA BENCH “SMC” AT KOLKATA Shiv Bhagwan Gupta S/o Lt. Badri Prasad G vs Asst. Commissioner of Income-tax, Central Circle-1, Patna.- ITA No.194/Pat/2019. Dated:- 20, March 2021 Short Summary Provisions of section 271AAB of Income Tax Act 1961, it is evident that the Section […]

Extended Due Date of Form GSTR-3B and GSTR-1 and other GST Compliance for the month of March, April, May-2021:-for All Types Tax Payers

Extended Due Date of Form GSTR-3B Month Taxpayers Types Extended Due Date March-2021 Small taxpayers (aggregate turnover up to Rs. 5 crore) Normal Taxpayers QRMP 19.06.2021 (60 days from the Due Date) 21.06.2021 (60 days from the Due Date) April-2021 Small taxpayers (aggregate turnover up to Rs. 5 crore) 04.07.2021 (45 days from the Due […]

COVID-19 Relief in 43rd GST Council meeting Dated 28.05.2021- With Press Release

Relief in of 43rd GST Council meeting The 43rd GST Council meeting under the Chairmanship of Finance Minister Smt. Nirmala Sitha raman through video conferencing here 28.05.2021. The meeting was also attended by Union Minister of State for Finance & Corporate Affairs Shri Anurag Thakur besides Finance Ministers of States & UTs and senior officers […]