जीएसटी अपडेट मासिक पत्रिका मई-2023- Pub Date 15.05.2023 Subscription Rates (Hindi) YEAR PRICE Click For Subscription (After Payment Send Receipton What’s App Number- 8386982822 ) 1 Year 299/- Subscribe 2 Year 499/- Subscribe Bank Option only 2 Year Name- LTG Publication Pvt Ltd Bank- IDBI Bank Ltd Account Number:- 1278102000010362 IFSC Code- IBKL0001278 Branch:- A-8, Central SPI, Vidhyadhar […]

Uncategorized

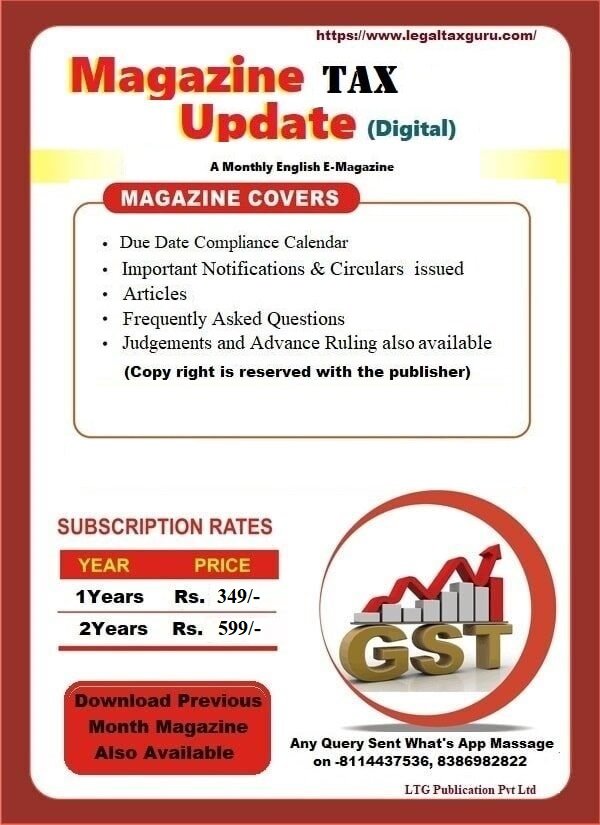

E-Magazine on Tax Update Hindi or English

Magazine on Tax Update After Payment Share Receipt on 8386982822 Also Subscription Option Available For Online Payment Subscription Charges Click below link E-Subscription Rates YEAR PRICE Click For Subscription of E-Tax Update (After Payment Send Receipton What’s App Number- 8386982822 )-Kindly do not Subscribe those who have already made Subscription of Tax English E […]

Compounding fee does not exceed the fine prescribed by penal section-Supreme Court

Compounding fee does not exceed the fine prescribed by penal section, the same cannot be declared to be either exorbitant or irrational or bereft of guidance.” HIGH COURT OF JUDICATURE FOR RAJASTHAN JODHPUR. M/S. Alwar Malt And Agro Foods vs State of Rajasthan on 11 March, 2019 “SB Civil Writ Petition No. 369/2016 titled as […]

E-Tax Magazine Monthly Magazine

E-Tax Magazine Monthly Magazine E-Subscription Rates Also Subscription Option Available Bank Option only 2 Year YEAR PRICE Click For Subscription of E-Tax Update (After Payment Send Receipt on What’s App Number- 8386982822 ) Kindly do not Subscribe those who have already made Subscription of Tax English E Magazine Subscriber 1 Year 349/- Subscribe 2 Year […]

E-जीएसटी अपडेट (हिन्दी) मासिक पत्रिका

E-जीएसटी अपडेट (हिन्दी) मासिक पत्रिका For Online Payment Subscription Charges Click Below Link E-Subscription Rates Also Subscription Option Available Subscription Rates (Hindi) YEAR PRICE Click For Subscription (After Payment Send Receipton What’s App Number- 8386982822 ) 1 Year 299/- Subscribe 2 Year 499/- Subscribe Download Free (Hindi) Download मासिक पत्रिका सितंबर-2021 Download Bank Option […]

गुजरात उच्च न्यायालय:- जीएसटी प्राधिकरण द्वारा किसी भी आदेश को पारित करने से पहले सुनवाई का अवसर प्रदान किया जाना

गुजरात उच्च न्यायालय:- जीएसटी प्राधिकरण द्वारा किसी भी आदेश को पारित करने से पहले सुनवाई का अवसर प्रदान किया जाना गुजरात उच्च न्यायालय ईगल फाइबर्स लिमिटेड बनाम गुजरात राज्य S.S.G. Apparels Vs Deputy Assistant Commissioner GST (Central Taxes) अपील संख्या: Special Civil Application No. 17506 of 2022 निर्णय/आदेश की तिथि : 12/01/2023 माननीय एम.एस. […]

जीएसटी अपडेट (हिन्दी) Or Legal Tax Update English मासिक पत्रिका

जीएसटी अपडेट (हिन्दी) Or English मासिक पत्रिका Subscription for Online Publication for Any Query and Complaint Call- 08386982822, and Send What’s… जीएसटी अपडेट (हिन्दी) Subscription for Online Publication for Any Query and Complaint Call- 08386982822, and Send What’s App Message-08386982822, 08114437536 E- Mail ID- legaltaxguru.com@gmail.com, legaltaxguruhosting@gmail.com Subscription Rates (Hindi) YEAR PRICE Click For Subscription (After Payment Send […]

Important GST and other Due Date Calendar month of Aug-2021

Important Due Date Calendar Month of Aug-2021 Due Date Calendar Month of Aug-2021 31st Aug 2021 Form DPT 3 Form for companies 31st Aug 2021 Form 11 for LLP 31St July 2021 Issuance of Form 16 to Employees 07th Aug-2021 TDS Payment for July 11th Aug 2021 GSTR 1 (Monthly) for July 13th Aug 2021 […]

E-Magazine on GST Update- Also Available Previous month Free Download

Subscription E-Magazine on GST Update Magazine on GST Update (LTG Publication Pvt Ltd) is a monthly magazine of www.legaltaxguru.com, a premier website for Tax and Legal Update in India. It is drafted by the experts in this region to help common man, professionals, students, Businessman etc. to explain, this highly technical law. A Complete Magazine […]

GST Return Deadlines Deadlines (Due Date) for the Month of October-2020

GST Updates & Deadlines (Due Date) for the Month of October-2020 Due Date Return/ Compliance Remarks 11st October 2020 GST Return GSTR-1 (Sep 20) Turnover More Than INR 1.5 Crore Return of Outward Supplies- Monthly Return 31st October 2020 GST Return GSTR-1 (July to Sep 20) Turnover up to INR 1.5 Crore Return of Outward […]