Thanks for extending the last date for ITR Assessment year 2019-20 (Finanicial year ending 31/03/2019) to 30th Sept. 2020.

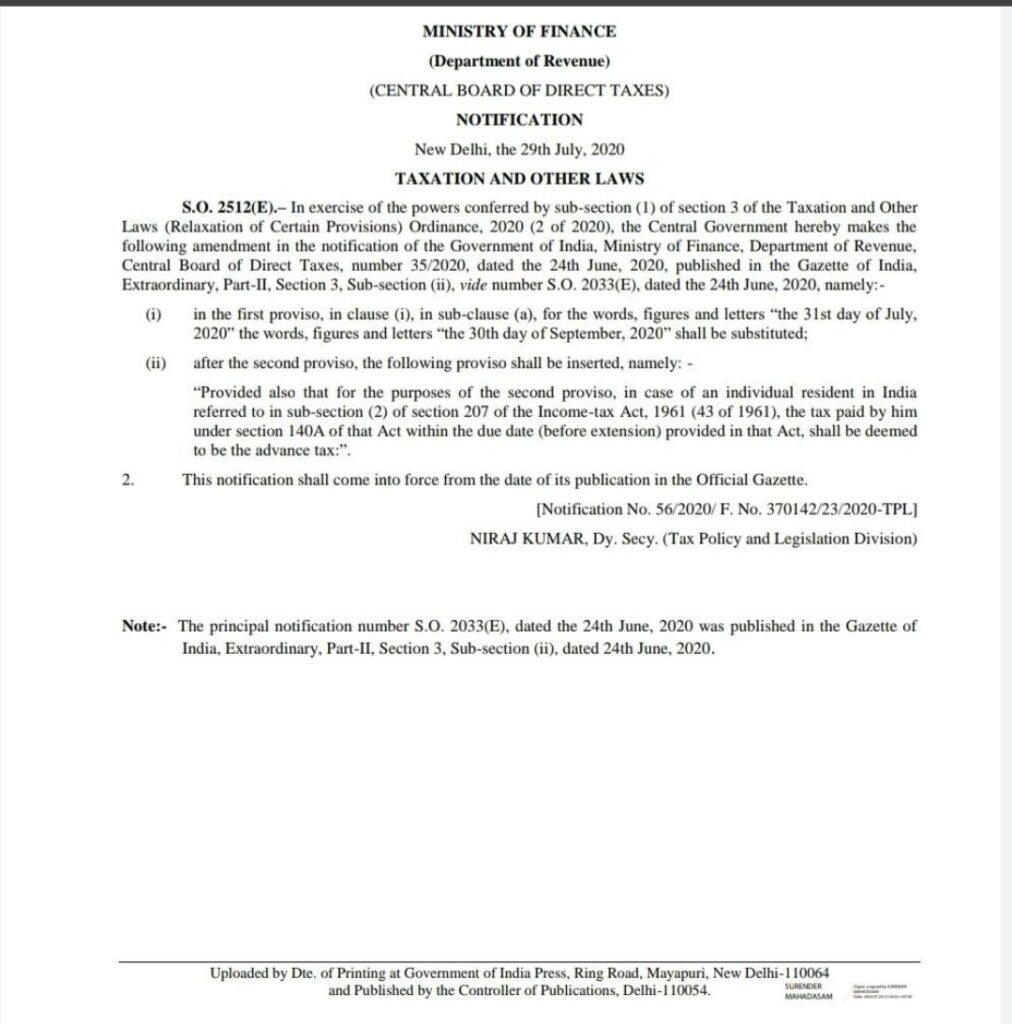

Due Dates (Extension of various time limits under Direct Tax & Benami laws) Extended by the CENTRAL BOARD OF DIRECT TAXES on 24th June 2020 vide Income Tax Notification No. 35/2020-Income Tax.

| Particular | Extended Due Date/Waiver |

| Income Tax Return Filing for Financial Year 2018-19: Belated or Revised Income Tax Return for F.Y 2018-19 | 31st July 2020. The earlier date was 30th June 2020 |

| TDS Return Due Date for Q4 of F.Y 2019-20 | 31st July 2020 earlier it was 30th June 2020. |

| TCS Return Due Date for Q4 of F.Y 2019-20 | 31st July 2020 earlier it was 30th June 2020. |

| Issue of Form 16 for F.Y 2019-20 | 15th Aug 2020 earlier it was 30th June 2020. |

| Issue of Form 16A for Financial Year 2019-20: | 15th Aug 2020 earlier it was 30th June 2020 |

| No Interest u/s 234A | Waiver of interest u/s 234A If the self-assessment tax is up to Rs 1 lakh. |

| Deduction Under Chapter VIA for Financial Year 2019-20: Deduction u/s 80C, 80D, etc | 31st July 2020. Earlier it was 30th June 2020. |

| Tax Audit Due Date for Financial Year 2019-20 | The Due date for Tax Audit is 31st Oct 2020. As Return filing Date is 30th Nov 2020 |

| Investment u/s 54 & 54GB: The date for taking benefit u/s 54 & 54GB | Extended to 30th September 2020 for Financial Year 2019-20. |

| Aadhar & Pan Linking Due Date | 31st March 2021 earlier it was 30th June 2020. If you don’t link your Aadhar with Pan, Your pan becomes inactive & you may have to pay penalty of Rs. 10,000/- |

| SEZ Operation for claiming benefit u/s 10AA for Financial Year 2019-20 | The date has been extended till 30th September 2020 |