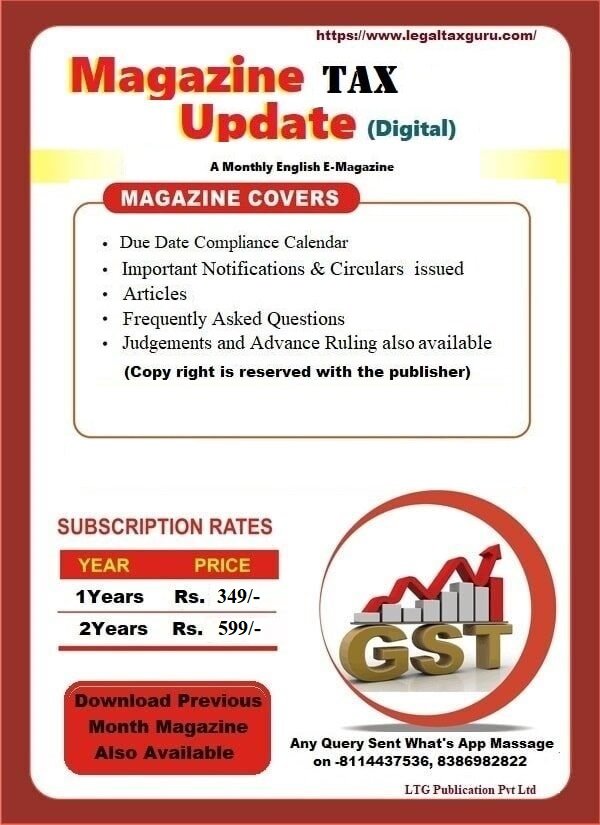

Magazine on Tax Update

After Payment Share Receipt on 8386982822

Also Subscription Option Available

For Online Payment Subscription Charges Click below link

E-Subscription Rates

Bank Option only 2 Year

| YEAR | PRICE | Click For Subscription of E-Tax Update

(After Payment Send Receipt Kindly do not Subscribe those who have already made Subscription of Tax English E Magazine Subscriber |

1 Year |

349/- |

|

2 Year |

599/- |

|

| Name- LTG Publication Pvt Ltd |

| Bank- IDBI Bank Ltd |

| Account Number:- 1278102000010362 |

| IFSC Code- IBKL0001278 |

| Branch:- A-8, Central SPI, Vidhyadhar Nagar, Jaipur Rajasthan-302039 |

| After Payment Share Receipt – 8386982822 with Name and Mail ID |

(After Payment Send Receipt on What’s App Number- 8386982822

Download Sample Tax/GST E Magazine

Download GST E-Magazine Sample Month of Dec 2022- |

|

| (Composition Scheme Special ) GST E-Magazine in English Sample |

|

Subscription Rates (Hindi)

YEAR |

PRICE |

Click For Subscription(After Payment Send Receipt

|

1 Year |

299/- |

|

2 Year |

499/- |

|

| Name- LTG Publication Pvt Ltd |

| Bank- IDBI Bank Ltd |

| Account Number:- 1278102000010362 |

| IFSC Code- IBKL0001278 |

| Branch:- A-8, Central SPI, Vidhyadhar Nagar, Jaipur Rajasthan-302039 |

| After Payment Share Receipt – 8386982822 with Name and Mail ID |

Download Free (Hindi)

|

-

भारतीय अतीत की दण्ड व्यवस्था बनाम भारत की वर्तमान दण्ड व्यवस्था ||Indian past punishment system vs present punishment system of India||Types of Punishment

Print PDF eBookजानिए अतीत की दण्ड व्यवस्था क्या थी |Know what was the punishment system of the past in india भारत में दण्ड के विकास की यात्रा अत्यंत लम्बी है | भारत की दण्ड व्यवस्था के निर्मम एवं बर्बर दण्ड से परिवीक्षा एवं भर्तसना जैसे सुधारात्मक दण्ड तक का सफ़र तय किया है | अतीत…

-

POWER OF A JUDGE TO PUT QUESTIONS TO ANY WITNESS, IN ANY FORM, AT ANY TIME

Print PDF eBookPOWER OF A JUDGE TO PUT QUESTIONS TO ANY WITNESS, IN ANY FORM, AT ANY TIME POWER OF A JUDGE TO PUT QUESTIONS TO ANY WITNESS, IN ANY FORM, AT ANY TIME Section 165 of the Indian Evidence Act, 1872 provides for the power of a judge to put questions to any witness…

-

GST Clarification on various issues pertaining to GST treatment of vouchers-Circular No. 243/37/2024-GST

Print PDF eBookClarification on various issues pertaining to GST treatment of vouchers- . Circular No. 243/37/2024-GST Dated the 31st December, 2024 References have been received from the trade and industry as well as the field formations seeking clarity on various issues with respect to vouchers such as whether transactions in voucher are a supply of…

-

EXEMPTIONS FROM CAPITAL GAINS UNDER INCOME TAX ACT

Print PDF eBookEXEMPTIONS FROM CAPITAL GAINS The Income-tax Act permits a capital gains tax exemption if the proceeds from the sale, or capital gains, as applicable, are used to purchase specific new assets. These exemptions are offered according to the following sections : 1. Section 54: Exemption from the capital gains arising from the transfer…