Enrolment of GST Practitioner has been started from 25th June

Section 48 of the Central Goods and Service Tax Act-2017 provides for the authorisation of an eligible person to act as approved GST practitioner. A registered person may authorize an approved GST practitioner to furnish information, on his behalf, to the government. The manner of approval of GST practitioners, their eligibility conditions, duties and obligations,the manner of removal and other conditions relevant for their functioning have been prescribed in Rule 24 and 25 of the GST Return Rules.

The following article discusses the Enrolment-GSTP ( in FORM GST PCT-01) on Site, and

eligibility criteria of GST practitioner, the procedure of Enrolment etc. to become a GST

practitioner first learn about eligibility criteria.

Note: – If there is any flaw in the information given or you have any questions then please

give it in the comment box.

These people can register as GST Practitioner (as per Rule 24 of the Return rules)

Any person who,

- is a citizen of India

- is a person of sound mind

- is not adjudged as insolvent

- has not been convicted by a competent court for an offense with imprisonment not

less than two years.

In addition, the person should also satisfy any of the following conditions:

(a) Is a retired officer of the Commercial Tax Department of any State Government or of the

CBEC and has worked in a post not lower in rank than that of a Group-B gazetted officer

for minimum period of two years

or

(b) Has been enrolled as a sales tax practitioner or tax return preparer under the existing law

for a period of not less than five years

he has passed or Education Qualification:-

a graduate or postgraduate degree or equivalent examination having a degree in Commerce,

Law, Banking including Higher Auditing, or Business Administration or Business Management

from any Indian University established by any law for the time being in force and he has

passed Final Exam of CA, CS, CMA,

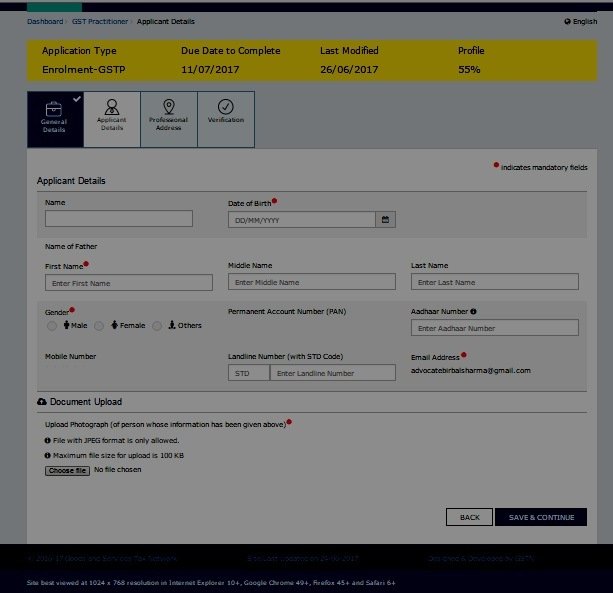

Form Filling Procedure

First opened (www.gst.gov.in) site and Click on Register Now in the column of GST

Practitioner and after the data feed Temporary Reference Number (TRN) will be received by

e-mail and the enrolment form will be filled on the site as follows :-

|

|

|

|

Important point

- To register for CA, Advocate, CS, CWA in FORM GST PCT-01, the details of their

membership number will be given and others will have to give their education details

and upload the following documents will be uploaded as a certificate of qualification

degree.

- Qualifying Degree

- Any other document

- Pension Certificate issued by AG office or LPC Etc.

- The applicant has to give his details like name, father’s name, PAN, Aadhar etc. and

upload one photo of himself. - The applicant must upload the following documents must be uploaded as proof of

business address.

- Property Tax Receipt

- Municipal Khata Copy

- Electricity bill

- Rent/Lease agreement

- Consent Letter

- Documents/Certificate issued by Government. Etc.

- The final stage of GSTR (FORM GST PCT-01)- The GST practitioner will have to verify the

application with the digital signature or Aadhaar Card OTP.

Other GST Return and Forms Links

- GST Draft return forms and Form for Goods and Services Tax Practitioner

- Relaxation in return filing (रिटर्न फाइलिंग में छूट)

- Refund Forms detail and Refund Procedure in GST

- Rate of Tax and draft formats on Composition Levy