Extends Due Date for filing of Audited Income Tax return

Dated- 08.10.2018 CBDT further extends due date for filing of Income Tax Returns & audit reports from 15th Oct,2018 to 31st Oct, 2018 for all assessees liable to file ITRs for AY 2018-19 by 30.09.2018,after considering representations from stakeholders. Liability to pay interest u/s234A of ITAct will remain

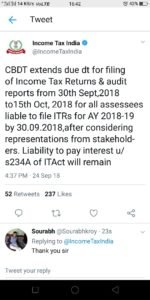

Dated 24.09.2018 Extends Due Date for filing of Audited Income Tax return

#lastdatetofileitrforay201819 #Incometaxauditduedateextended #taxauditduedateforay201819 #Incometaxreturn #taxauditduedateforay201819 #u/s234AofITAct

CBDT extends due dt for filing of Income Tax Returns & audit reports from 30th Sept,2018 to 15th Oct, 2018 for all assessees liable to file ITRs for AY 2018-19 by 30.09.2018,after considering representations from stakeholders. Liability to pay interest u/s234A of ITAct will remain.

Click Here to Other Post

क्या 3 वर्ष से ज्यादा अवधि से बकाया चल रहे, क्रेडिटर्स (Creditors) के बैलेंस को आयकर अधिकारी द्वारा करदाता की आय में जोड़ा जा सकता है ?

तलाशी के दौरान कितने आभूषण और गहनों को जब्त नहीं किया जा सकता है

आयकर कानून के सजा (कारावास) के प्रावधान

Magazine on Income tax amendments 2018 (Digital Product) Only 10 Rupees

Amend the section 44AE in Finance Bill-2018

Substitution of new Section 80AC budget 2018

(If you liked the Article, please Subscribe)

[email-subscribers namefield=”YES” desc=”” group=”Public”]