#lastdatetofileitrforay201819 #Incometaxauditduedateextended #taxauditduedateforay201819 #Incometaxreturn #taxauditduedateforay201819 #u/s234AofITAct

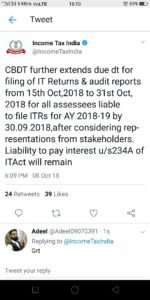

CBDT extends due dt for filing of Income Tax Returns & audit reports from 30th Sept,2018 to 15th Oct, 2018 for all assessees liable to file ITRs for AY 2018-19 by 30.09.2018,after considering representations from stakeholders. Liability to pay interest u/s234A of ITAct will remain.

आयकर कानून के सजा (कारावास) के प्रावधान

Magazine on Income tax amendments 2018 (Digital Product) Only 10 Rupees

Amend the section 44AE in Finance Bill-2018

Substitution of new Section 80AC budget 2018

Circular No. 214/1/2023-Service Tax date: 28th February, 2023 An issue has arisen on the levy…

Introduction Consumer protection is a crucial aspect of a well-functioning market economy, ensuring fairness, transparency,…

Circular No. 1076/02/2020- Cx Date: 19th Nov 2020 References have been received from the field…

Union Budget 2025 Key features\Finance Bill 2025 Direct Tax proposals Introduction of a scheme for…

Clarification on various issues pertaining to GST treatment of vouchers- . Circular No. 243/37/2024-GST Dated…

EXEMPTIONS FROM CAPITAL GAINS The Income-tax Act permits a capital gains tax exemption if the…