INPUT TAX CREDIT ELIGIBLE ON FREE SUPPLY OF GOODS AS A PART OF CSR ACTIVITIES

THE AUTHORITY ON ADVANCE RULINGS

UTTAR PRADESH

Case Name : Dwarikesh Sugar Industries Limited

Appeal Number : Order No. 52

Date of Judgement/Order : 22/01/2020

RULING

Question 1:- Whether expenses incurred by the Company in order to comply with requirements of Corporate Social Responsibility (CSR) under the Companies Act, 2013 (`CSR Expenses’) qualify as being incurred in the course of business and eligible for input tax credit (`ITC’) in terms of the Section 16 of the Central Goods and Services Tax Act, 2017 (`CGST Act, 2017′)?

Answer:– Yes.

Question 2:- Whether free supply of goods as a part of CSR activities is restricted under Section 17 (5) (h) of CGST Act, 2017?

Answer:- No

Question 3:- Whether goods and services used for construction of school building which is not capitalized in the books of accounts is restricted under Section 17 (5) (c) / 17 (5) (d) of CGST Act, 2017

Answer:- ITC is not available to the extent of capitalisation.

17) This ruling is valid subject to the provisions under Section 103(2) until and unless declared void under Section 104(1) of the CGST Act, 2017.

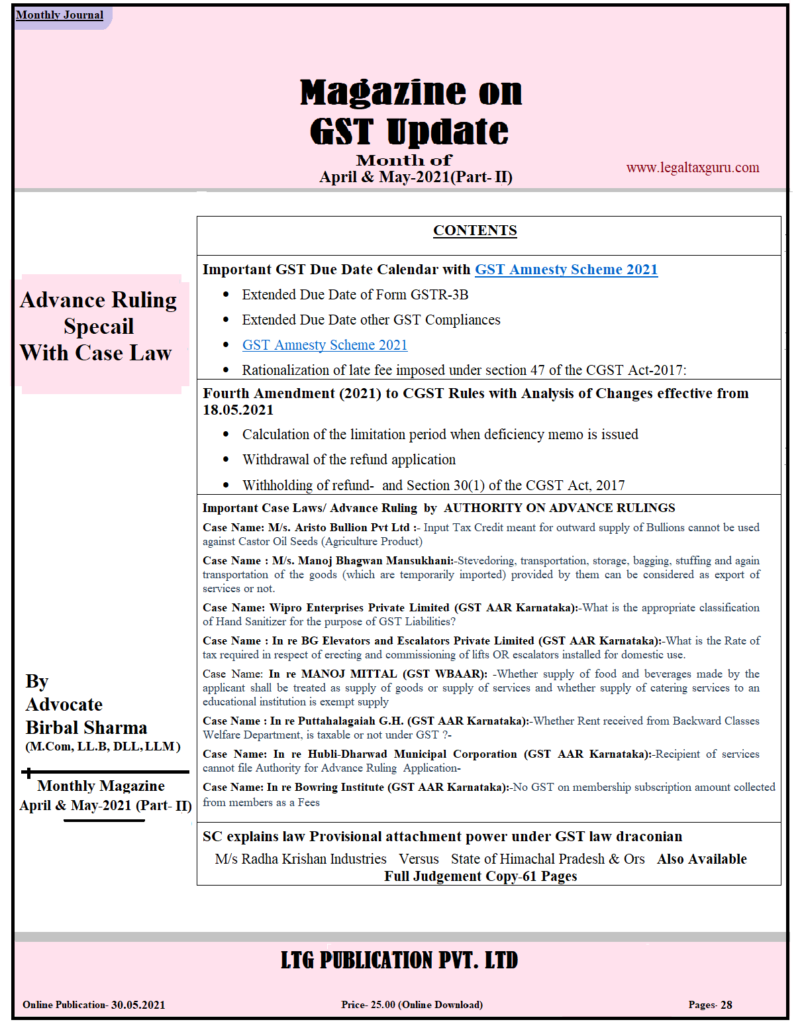

E-Magazine on GST Update in Hindi or English

Subscription for Online Publication

A Complete Magazine on GST

|

Subscription for Online Publication

for Any Query and Complaint Call- 08386982822, and Send What’s App Message-08386982822, 08114437536 E- Mail ID- legaltaxguru.com@gmail.com,

Subscription Rates (English)

| YEAR | PRICE | Click For Subscription (After Payment Send Receipt on What’s App Number- 8386982822 ) |

| 1 Year | 250/- |

|

| 2 Year | 450/- |

|

Download Free (English)

|

Download GST MAGAZINE UPDATE MONTH OF APRIL-MAY 2021 (PART-II)-Use Password- Ltgmay@1234

|

|

| (Composition Scheme Special ) GST E-Magazine in English Sample |

Bank Option only 2 Year

| Name- LTG Publication Pvt Ltd |

| Bank- IDBI Bank Ltd |

| Account Number:- 1278102000010362 |

| IFSC Code- IBKL0001278 |

| Branch:- A-8, Central SPI, Vidhyadhar Nagar, Jaipur Raasthan-302039 |

| After Payment Share Receipt – 8386982822 with Name and Mail ID |

Use Password- Ltgmay@1234

Subscription Rates (Hindi)

YEAR |

PRICE |

Click For Subscription(After Payment Send Receipt

|

1 Year |

300/- |

|

2 Year |

500/- |

|

| Name- LTG Publication Pvt Ltd |

| Bank- IDBI Bank Ltd |

| Account Number:- 1278102000010362 |

| IFSC Code- IBKL0001278 |

| Branch:- A-8, Central SPI, Vidhyadhar Nagar, Jaipur Raasthan-302039 |

| After Payment Share Receipt – 8386982822 with Name and Mail ID |

Download Free (Hindi)

|