Key Highlights of Budget 2020 (Announcements)

Budget Income Tax Announcements

- Income Tax Rate

- 10% income tax rate for Income between 5,00,000.00 -7,50,000 Rupees

- 15% income tax rate for Income between 7,50,000 -10,00,000.00 Rupees

- 20% income tax rate for Income between 10,00,000.00 -12,50,000.00 Rupees

- 25% income tax rate for Income e between 12,50,000.00-15,00,000.00 Rupees

- Incomes above 15,00,000.00 Rupees remain at 30%

- No tax for income up to 5,00,000.00 Rupees

2.Income Tax Slab

|

New Income Tax Rate |

Income |

Old Income Tax Rate |

|

10% |

Income between 5,00,000.00 -7,50,000 Rupees

|

20% |

|

15% |

Income between 7,50,000 -10,00,000.00 Rupees |

20% |

|

20% |

Income between 10,00,000.00 -12,50,000.00 Rupees |

30% |

|

25% |

Income e between 12,50,000.00-15,00,000.00 Rupees |

30% |

|

30% |

Incomes above 15,00,000.00 Rupees |

30% |

- Proposed 100% tax concession to sovereign wealth funds on investment in infra projects.

- Concessional tax rate of 15% extended to power generation companies.

- Dividend Distribution Tax shifted to individuals instead of companies

- Section 44AB Turnover threshold for audit increased to 5 crore from 1 crore rupees (Condition for businesses carrying out less than 5% business transaction in cash

Budget GST Announcements

- Simplified Returns from April 1st

- GST Taxpayers verification based on Aadhaar

Budget Customs duty Announcements

- Customs duty raised

- Footwear to 35% from 25%

- Furniture goods to 25% from 20%

Budget Healthcare Announcements

- 690 billion Rupees will be spent toward healthcare spending

Budget Transport Announcements

- 100 more airports are planned by 2024

- Over 6,000 km of highways in 12 lots will be monetized by 2024

- One major airport will be privatized

Budget Banking Announcements

- Bank deposit insurance cover increased from 1 lakh Rupees to 5 lakh Rupees

Budget Infrastructure Announcements

- 5 new smart cities in public-private partnership mode

- Delhi-Mumbai Expressway to be completed by 2023

- 100 and more airports to be developed by 2024

Budget Agriculture/Irrigation and Rural Announcements

- 1.60 Lakh Cores Rupees Agriculture/Irrigation and Rural and allied activities Development

- 1.23 Lakh crore for Rural development and Panchayati raj

Download Copy of Union Budget

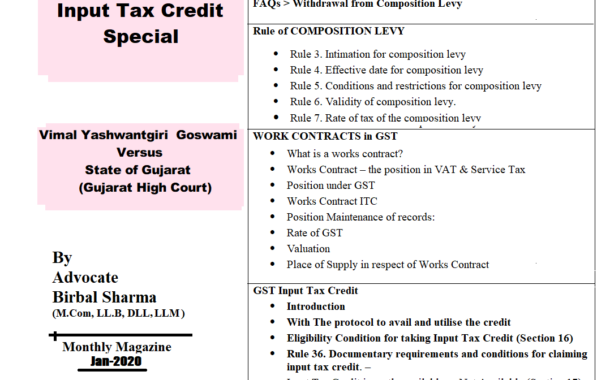

GST Magazine Update Month of Jan-2020 (Digital) || Input Tax Credit Special

Posted By: Advocate Birbal Sharmaon: January 24, 2020In:Tags:

GST Magazine Update Month of Jan-2020 || Input Tax Credit Special Online Edition :21.01.2020 Pages -37 Price – 25 Click Below link for buy Sr.No CONTENTS Page No. 1. Importa… Read more Share0TweetShare0

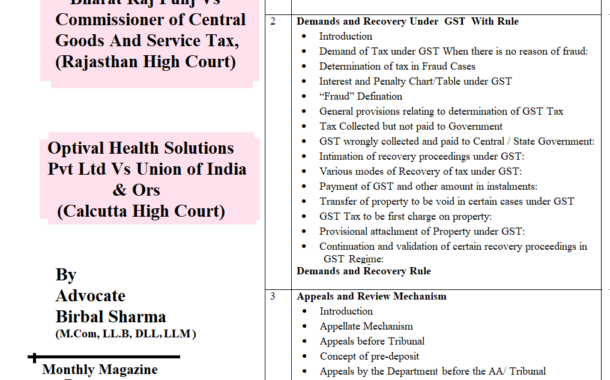

GST Update Month of December-2019(Digital) || Magazine on GST Update

Posted By: Advocate Birbal Sharmaon: December 22, 2019In:Tags:

GST Magazine Month of December-2019 Pages-36 Prices- 25 Rupees Sr.No CONTENTS Page No. 1 Important GST Due Date Calendar (other than J & K) Due date of filing of GSTR-3B for the month of… Read more Share0TweetShare0

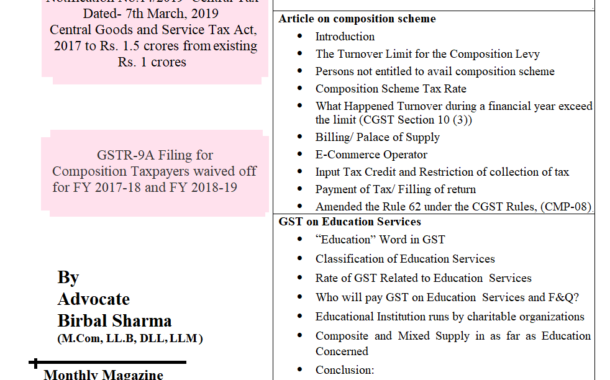

GST Update Month of Nov-2019(Digital) || Magazine on GST Update

Posted By: Advocate Birbal Sharmaon: November 29, 2019In:Tags:

GST Magazine Month of Nov-19 Pages-31 Prices- 20 Rupees Sr.No CONTENTS Page No. 1 Important GST Due Date Calendar 3-4 2 Article on composition scheme • Introduction • The T… Read more Share0TweetShare0