Person liable for Registration under GST with Amendment

Person liable for Registration under GST :- The provision of GST registration has been prescribed under chapter VI of the CGST Act, 2017 and Section 22 of the CGST Act, deals with Person liable for registration under GST

- Person liable for registration under GST (Goods and Service Tax)

As per Section 22 of the This Act, specified that “Every supplier shall be liable to be GST registered under this Act in the State or Union territory, other than special category States, from where he makes a taxable supply of goods or services or both, if his aggregate turnover in a F.Y (financial year) exceeds 20 (Twenty) lakh rupees”

But the person makes taxable supplies of goods or services or both from any of the special category States; he shall be liable to be GST registered if his aggregate turnover in a financial year exceeds 10 (ten) lakh rupees.

Amendment in -2018

|

Amendment in -2018– In section 22 of the principal Act, –– (a) in sub-section (1), after the proviso, the following proviso shall be inserted, namely: — “Provided further that the Government may, at the request of a special category State and on the recommendations of the Council, enhance the aggregate turnover referred to in the first proviso from ten lakh rupees to such amount, not exceeding twenty lakh rupees and subject to such conditions and limitations, as may be so notified.”; (b) in the Explanation, in clause (iii), after the words “ ( J&K )State of Jammu and Kashmir”, the words “and States of Arunachal Pradesh, Assam, Himachal Pradesh, Meghalaya, Sikkim and Uttarakhand” shall be inserted.”. |

Every person who is holding a license or GST registration under the earlier laws shall be liable to be GST registered under this Act, with effect from 01st July 2017.

| Amendment in 2019 of Section 22 : –. In section 22 of the (CGST) Central Goods and Services Tax Act, in sub-section (1), after the second proviso, the following shall be inserted, namely: ––

“Provided also that the Government may, at the request of a State and on the recommendations of the Council, enhance the aggregate turnover from (twenty) 20 lakh rupees to such amount not exceeding (forty) 40 lakh rupees in case of supplier who is engaged exclusively in the supply of goods, subject to such conditions and limitations, as may be notified. Explanation. ––For the purposes of this sub-section, a person shall be considered to be engaged exclusively in the supply of goods even if he is engaged in exempt supply of services provided by way of extending deposits, loans or advances in so far as the consideration is represented by way of interest or discount.”.

|

When a business carried on by a taxable person registered under the GST Act is transferred on account of succession or otherwise, to another person as a going concern, the transferee or the successor as the case may be liable to be GST registered with effect from the date of such transfer or succession.

In a case of transfer pursuant to sanction of a scheme or an arrangement for amalgamation of Company or, as the case may be, demerger of two or more companies pursuant to an order of a any High Court, Tribunal or otherwise, the transferee shall be liable to be registered, with effect from the date on which the GST Registrar of Companies issues a (COI) certificate of incorporation giving effect to such order of the any High Court or Tribunal.

For the purposes of (section 22) this section there are certain points has been clarified as under, ––

(i) the expression “aggregate turnover” shall include all supplies made by the taxable person, whether on his own account or made on behalf of all his principals;

(ii) the supply of goods, after completion of job work, by a (GST) registered job worker shall be treated as the supply of goods by the principal referred to in section 143 of this act, and the value of such goods shall not be included in the aggregate turnover of the registered job worker;

(iii) the expression “special category States” shall mean the States as specified in sub-clause (g) of clause (4) of article 279A of the Indian Constitution.

Thus, from the above analysis there are two terms are very important needs to be defined before proceeding to further analysis of the topic and the two words are namely “supplier” and “aggregate turnover”

As per Section 2 (105) of the CGST Act, defines “Supplier” in relation to any goods or services or both, shall mean the person supplying the said goods or services or both and shall include an agent acting as such on behalf of such supplier in relation to the goods or services or both supplied;

As per Section 2(6) of the CGST Act, defines “aggregate turnover” means the aggregate value of all GST (Taxable) supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis), exempt supplies, exports of goods or services or both and inter-State supplies of persons having the same Permanent Account Number, to be computed on all India basis but excludes (CGST) central tax, State tax (SGST), Union territory tax (UGST), integrated tax (IGST) and cess;

Advance Rulings related to GST Registration

A Separate registration to multiple companies functioning in a ‘co-working space: It was held by AAR Kerala (2019) in re Spacelance Office Solutions P Ltd (Advance Ruling No. KER/55/2019 Dated: 15/07/2019 )

that there is no prohibition under GST law for obtaining GST registration to a shared office space or virtual office if landlord permits such sub-leasing as per Rent agreement. Thus, separate GST registration can be allowed to multiple companies functioning in a ‘co-working space,’ and such companies shall upload rental agreement with landlord and lessee as proof of address of the principal place of business of respective suit or desk number assigned to them

In addition to this, the applicants can upload a copy of “monthly utility bill” in connection with payment towards electricity charges, water charges or other common services availed by the respective suit or desk number.

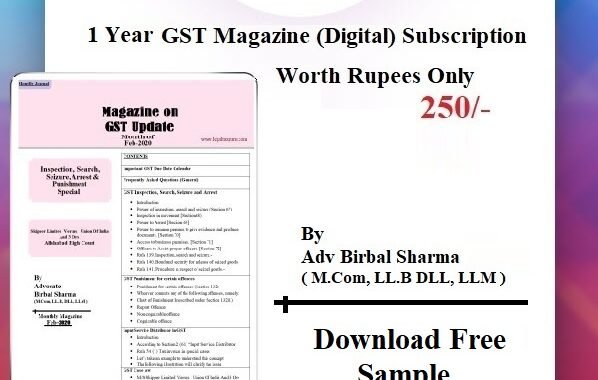

Download GST E-Magazine Sample Free ( Input Tax Credit Special ) and Annual Subscription

Posted By: (Team) LTG Publication Private Limitedon: September 29, 2020In: Feature Post, GST, GST ArticleNo Comments

Subscription GST E-Magazine GST E-Magazine (LTG Publication Pvt Ltd) is a monthly magazine of www.legaltaxguru.com, a premier website for Tax and Legal Update in India. It is drafted by the… Read more