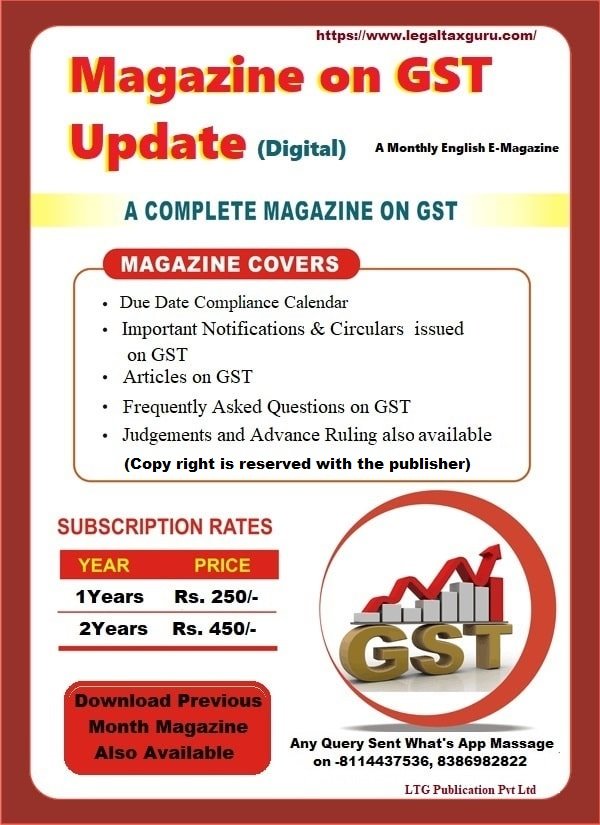

जीएसटी अपडेट (हिन्दी) Or English मासिक पत्रिका Subscription for Online Publication for Any Query and Complaint Call- 08386982822, and Send What’s… जीएसटी अपडेट (हिन्दी) Subscription for Online Publication for Any Query and Complaint Call- 08386982822, and Send What’s App Message-08386982822, 08114437536 E- Mail ID- legaltaxguru.com@gmail.com, legaltaxguruhosting@gmail.com Subscription Rates (Hindi) YEAR PRICE Click For Subscription (After Payment Send […]

Tag: GST Magazine online

IS ITC ELIGIBLE ON CAPITAL GOODS (GOOD AND SERVICE) PROCURED FOR BUILDING LNG JETTIES ?

ITC NOT ELIGIBLE ON CAPITAL GOODS PROCURED FOR BUILDING LNG JETTIES GUJARAT APPELLATE AUTHORITY FOR ADVANCE RULINGGOODS AND SERVICES TAX Case Name: Swan LNG Pvt. Ltd (GST AAAR)Advance Ruling No. GUJ/GAAAR/APPEAL/2022/06Date of Judgement/Order: 09/05/2022 Important Point of AAAR Order In view of the above discussion, we find that the LNG Jetties being built by the […]

Legal Tax Update E-Magazine Subscriptions

Legal Tax Update Law Update E-Magazine Subscriptions (Available Only Digital) Magazine on Corporate Law Update (LTG Publication Pvt Ltd) is a monthly magazine of www.legaltaxguru.com, a premier website for Tax and Legal Update in India. It is drafted by the experts in this region to help common man, professionals, students, Businessman etc. to explain, this […]

IS GST PAYABLE ON ACCOMMODATION SERVICES IF PER DAY DECLARED TARIFF OF A UNIT, IS BELOW RS.1000 ?

GST NOT PAYABLE ON ACCOMMODATION SERVICES IF PER DAY DECLARED TARIFF OF A UNIT, IS BELOW RS. 1000 KARNATAKA AUTHORITY FOR ADVANCE RULINGGOODS AND SERVICES TAX Case Name: Healersark Resources Private Limited (GST AAR Karnataka)Appeal Number: Advance Ruling No. KAR ADRG 75/2021Date of Judgement/Order: 06/12/2021 RULING a)The applicable GST SAC for the supply of service […]

जीएसटी अपडेट (हिन्दी) जून-2022 Date of Pub. :-16.06.2022

जीएसटी अपडेट (हिन्दी) जून-2022 Date of Pub. :-16.06.2022 Price-30/- Subscription for Online Publication 01 Year Rs. 300/– 02 Year Rs. 500/- Call for Booking and Complaint- 08114437536 WhatsApp Number-08114437536, 8386982822 E- Mail ID- legaltaxguru.com@gmail.com जीएसटी अपडेट (हिन्दी) Subscription for Online Publication for Any Query and Complaint Call- 08386982822, and Send What’s App Message-08386982822, 08114437536 E- Mail ID- legaltaxguru.com@gmail.com, legaltaxguruhosting@gmail.com Subscription Rates (Hindi) YEAR […]

WHAT IS THE APPROPRIATE CLASSIFICATION OF HAND SANITIZER FOR THE PURPOSE OF GST LIABILITIES?

THE AUTHORITY FOR ADVANCE RULINGS IN KARNATAKA GOODS AND SERVICES TAX Case Name: Wipro Enterprises Private Limited Appeal Number: Advance Ruling No. KAR ADRG 08/2021 Date of Judgement/Order: 26/02/2021 RULING 1. The hand sanitizers are classifiable under Heading 3808 under the Customs Tariff Act. 2. The hand sanitizers are liable to tax at the rate […]

IS GST ON PICK-UP CHARGES PAID TO THE OWNER / DRIVER ?

THE AUTHORITY ON ADVANCE RULINGSIN KARNATAKA Case Name: Kou-Chan Technologies Private Limited Appeal Number: Advance Ruling No. KAR ADRG 22/2021Date of Judgement/Order: 07-04-2021 RULING Question 1: Do the various supplies (of the applicant, the vehicle owner, the driver and the associate partner together) qualify as Composite supply?Answer:- No, it’s not a composite supply. Question 2:- Do […]

IS ITC ELIGIBLE ON FREE SUPPLY OF GOODS ?

INPUT TAX CREDIT ELIGIBLE ON FREE SUPPLY OF GOODS AS A PART OF CSR ACTIVITIES THE AUTHORITY ON ADVANCE RULINGSUTTAR PRADESH Case Name : Dwarikesh Sugar Industries LimitedAppeal Number : Order No. 52Date of Judgement/Order : 22/01/2020 RULING Question 1:- Whether expenses incurred by the Company in order to comply with requirements of Corporate Social […]

IS GST APPLICABLE ON HOSTEL RENT ?

GST IS NOT APPLICABLE ON HOSTEL RENT OF LESS THAN RS. 1K PER DAY FOR PER STUDENT MAHARASHTRA AUTHORITY FOR ADVANCE RULINGGOODS AND SERVICES TAX Case Name: Ghodawat Eduserve LLP Appeal Number: Advance Ruling No. GST-ARA- 72/2019-20/B-51Date of Judgement/Order: 27/08/2021 ORDER (Under section 98 of the Central Goods and Services Tax Act, 2017 and the Maharashtra […]