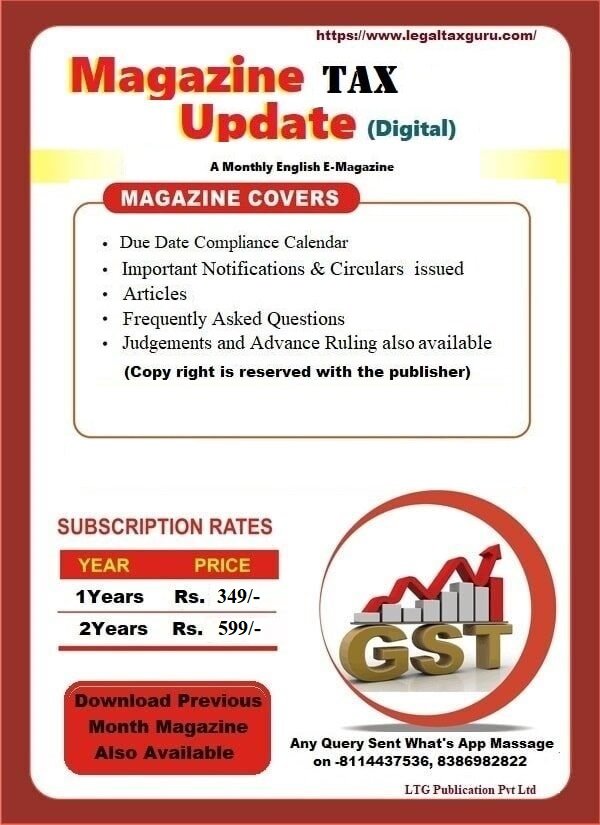

E-Tax Magazine Monthly Magazine E-Subscription Rates Also Subscription Option Available Bank Option only 2 Year YEAR PRICE Click For Subscription of E-Tax Update (After Payment Send Receipt on What’s App Number- 8386982822 ) Kindly do not Subscribe those who have already made Subscription of Tax English E Magazine Subscriber 1 Year 349/- Subscribe 2 Year […]

Tag: legaltaxguru

Availability of credit in special circumstances Under GST (Section 18).

Availability of credit in special circumstances Under GST (Section 18). availability of credit in special circumstances under gst In case of new registration, shifting from composition scheme & exempt supply becomes taxable supply [Section 18 (1)(a)] a GST person who has applied for registration under the GST Act within 30 (thirty) days from the date […]

Extended due date for furnishing Annual Return in GSTR-9 and 9C

Extended due date for furnishing Annual Return in GSTR-9 and 9C “After obtaining due clearances from the Election Commission in view of the Model Code of Conduct, Government has extended due date for furnishing Annual Return in GSTR–9 and 9C for 2018-2019 from 30st Sep.2020 to 31st.Oct.2020,” said a tweet from @cbic_india. Subscription GST E-Magazine GST E-Magazine (LTG Publication Pvt Ltd) is a monthly […]

यदि कोई व्यक्ति अनजाने में धर्म का अपमान करता है तो क्या वह धारा 295-अ का दोषी होगा ?||If a person unknowingly insults religion, will he be guilty of Section 295-A?

यदि कोई व्यक्ति अनजाने में धर्म का अपमान करता है तो क्या वह धारा 295-अ का दोषी होगा ? (section 295a ipc in hindi) उपरोक्त प्रश्न का जवाब है नहीं, यदि कोई व्यक्ति अनजाने में बिना किसी गलत उद्देश्य के किसी भी वर्ग के धर्म का अपमान करता है, तो उसे सजा नहीं दी जाएगी,क्योकि […]

What is Transit remand? ||With Example

What is Transit remand? What is Transit remand:- Transit remand is defined in Section 80 of the Code of Criminal Procedure If a warrant of arrest is executed outside the district in which it was issued — unless the court that issued the warrant is within 30 km (thirty kilometres) the person has to be produced in a […]

Eligible Business under section 44AD ||Who is eligible and not eligible to take advantage of the presumptive taxation scheme of section 44AD?

Eligible Business under section 44AD The presumptive taxation scheme of section 44AD of income tax Act 1961 can be adopted by following persons: Resident Individual Resident Hindu Undivided Family (HUF) Resident Partnership Firm (not LLP (Limited Liability Partnership Firm) Section 44ADA of Income Tax Act for AY 2018-19 {Section 44AD in Hindi} In other words, […]

What is pre-construction period?||Home loan tax benefit

What is pre-construction period? While computing income chargeable to tax under the head “Income from house property” in case of a let-out property, the taxpayer can claim deduction under section 24(b) of income tax act on account of interest on loan taken for the purpose of construction of home, purchase, repair, renewal or reconstruction of […]

क्या रेलवे में आरक्षित डिब्बे में यात्रा करते वक्त अगर अनाधिकृत व्यक्ति द्वारा चोरी की जाती है, तो रेलवे की क्या जिम्मेदारी बनती है ? ||What is the responsibility of the Railways, when it is stolen by an unauthorized person while traveling in a reserved compartment in the railway?

क्या रेलवे में आरक्षित डिब्बे में यात्रा करते वक्त अगर अनाधिकृत व्यक्ति द्वारा चोरी की जाती है, तो रेलवे की क्या जिम्मेदारी बनती है ? यह एक अच्छा प्रश्न है, जो कि एक आम आदमी के दिमाग में जब वह रेलवे में सफर करता है तो आना वाजिब है, क्योंकि संसार का हर व्यक्ति कंजूमर […]

What are the provisions relating to computation of capital gain in case of transfer of asset by way of gift, or through Will, etc.? || Capital Gain on Gifted Assets

Capital Gain on Gifted Assets Capital gain arises if a person transfers a capital asset. (land, building or jewelry or share etc). section 47 of the Income-Tax Act, 1961 excludes various transactions from the definition of ‘transfer. Thus, transactions covered under section 47 are not deemed as ‘transfer’ and, hence, these transactions will not give […]

Procedure for GST registration ||Section 25 of CGST Act

Provision for GST registration.-Section 25 of CGST Act Every person/trader who is liable to be registered under section 22 or section 24 of CGST Act shall apply for GST registration in every such State or Union territory in which he is so liable within Persons/Trader not liable for registration. Compulsory GST registration in certain cases. […]