Waiver of interest and late fee under GST for the month of March and April, 2021

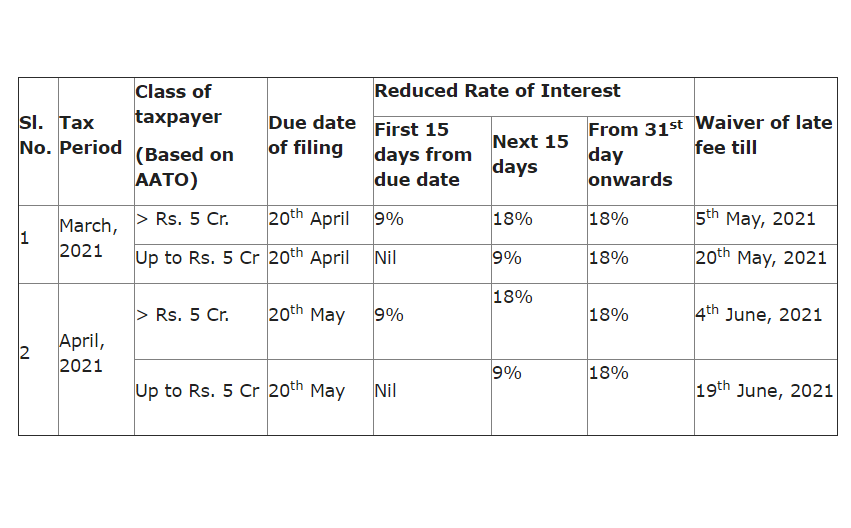

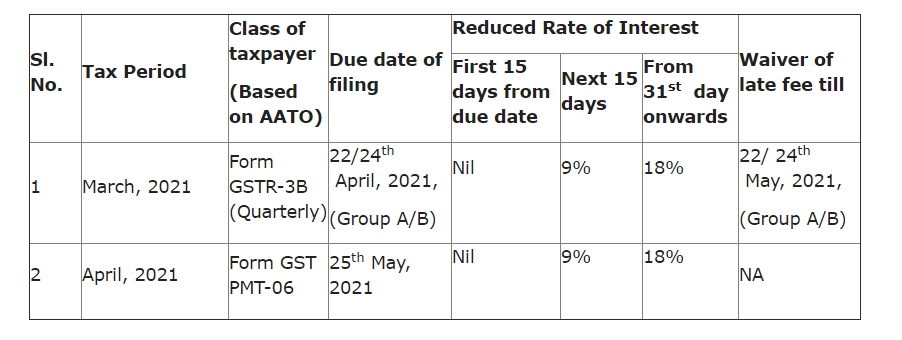

Government has granted waiver from payment of interest and/or late fee to normal & composition taxpayers (Monthly / Quarterly) for the month of March and April, 2021, through Central Tax Notification No. 08/2021 and Notification No. 09/2021, both dated 1st May, 2021. The details are summarized below:

Also Read

Extension in dates of various GST Compliances (GSTR-4, GSTR-5, GSTR-6, GSTR-7, GSTR-8. GSTR-1 for GST Taxpayers

[button color=”blue” link=”https://www.legaltaxguru.com/extension-in-dates-of-various-gst-compliances/” size=”big” outer_border=”true” outer_border_color=”#aaaaaa” icon=”undefined” icon_color=”#821a1a”]Click Here[/button]

[button color=”blue” link=”https://www.legaltaxguru.com/extension-due-date-for-income-tax-compliances-to-provide-relief-to-taxpayers-in-view-of-the-severe-pandemic-covid-19/” size=”big” target=”_blank” outer_border=”true” outer_border_color=”#aaaaaa” icon=”undefined” icon_color=”#821a1a”]Click Here[/button]

Relaxation to normal taxpayers in filing of monthly return in Form GSTR-3B

Relaxation in filing of Form GSTR-3B (Quarterly) by Taxpayers under QRMP Scheme

Relaxations in filing Form CMP-08 for Composition Taxpayers:

For Quarter of Jan-Mar-2021, instead of 18th April-2021, Composition Scheme Taxpayers can now file their quarterly return in Form CMP-08, without interest up to 3rd May- 2021, with 9% reduced interest between 4th May to 18th May-2021, and with 18% interest from 19th May-2021 onwards.

[news_box style=”1″ link_target=”_blank” show_more=”on” header_background=”#cecece” header_text_color=”#631515″]

For Online Payment Subscription Charges Click below Button Subscription GST E-Magazine GST E-Magazine (LTG Publication Pvt Ltd) is a monthly magazine of www.legaltaxguru.com, a premier websi… Read more